Today, the EUR/USD pair is attempting to rise for the fourth day in a row, trying to gain support above the round level of 1.1600. The US Dollar Index (DXY), which reflects the value of the US currency against a basket of major currencies, has been falling for three consecutive days against a backdrop of pessimistic expectations regarding the Federal Reserve. In fact, market participants are currently pricing in roughly an 85% chance of a rate cut by the central bank in December, and recent statements from several Fed officials have only reinforced these expectations. In addition, mixed economic data released this week are not helping to ease sentiment. This, together with a positive market environment, weakens the dollar's status as a safe-haven asset and, as a result, supports the growth of the EUR/USD pair. On the opposite side of the pair, the euro is receiving some support from the cautious stance and forecasts of the ECB regarding monetary policy. On Wednesday, ECB Vice President Luis de Guindos expressed moderate optimism about economic growth and confirmed that the current level of interest rates is appropriate. In addition, the head of the Croatian central bank, Boris Vujcic, emphasized that the ECB should resume lowering interest rates only if inflation falls below the target and does not rise again. ECB Chief Economist Philip Lane also noted the need for a slowdown in non-energy inflation to keep the overall price level close to 2%.

On the opposite side of the pair, the euro is receiving some support from the cautious stance and forecasts of the ECB regarding monetary policy. On Wednesday, ECB Vice President Luis de Guindos expressed moderate optimism about economic growth and confirmed that the current level of interest rates is appropriate. In addition, the head of the Croatian central bank, Boris Vujcic, emphasized that the ECB should resume lowering interest rates only if inflation falls below the target and does not rise again. ECB Chief Economist Philip Lane also noted the need for a slowdown in non-energy inflation to keep the overall price level close to 2%.

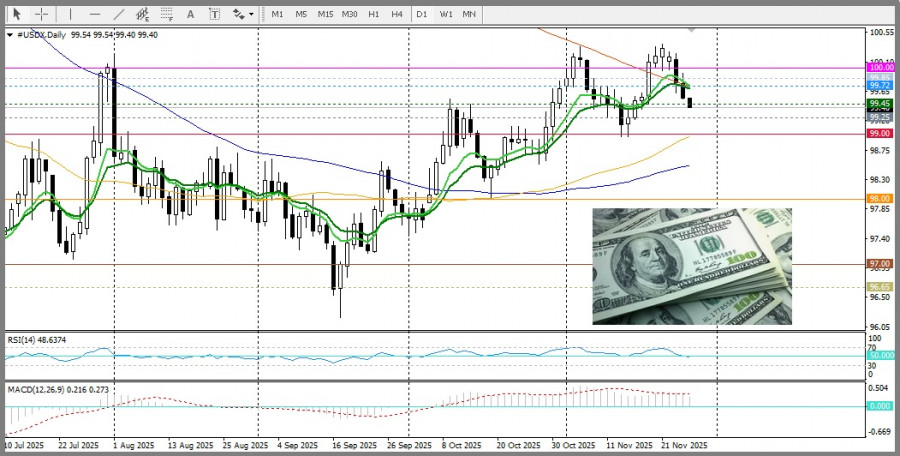

Meanwhile, most experts predict that the ECB will leave the deposit rate unchanged this year and will not make adjustments until the end of next year. This, in turn, benefits euro bulls by suggesting that the most likely scenario for the EUR/USD pair is upward. Nevertheless, before counting on further growth, it would be wise to wait for a sustained breakout above the 50-day Simple Moving Average (SMA), which is currently near 1.1622. Moreover, modest trading volumes ahead of the US Thanksgiving holiday require increased caution from traders who are betting on the pair's rise.

From a technical perspective, the oscillators on the daily chart are mixed. The pair faces resistance at the round level 1.1600, as well as at the 50-day SMA, which currently sits near 1.1622. A breakout above this level could give the bulls confidence. The pair has found support at 1.1585. The next support is at 1.1570, where the 14-day EMA and the 20-day SMA converge.

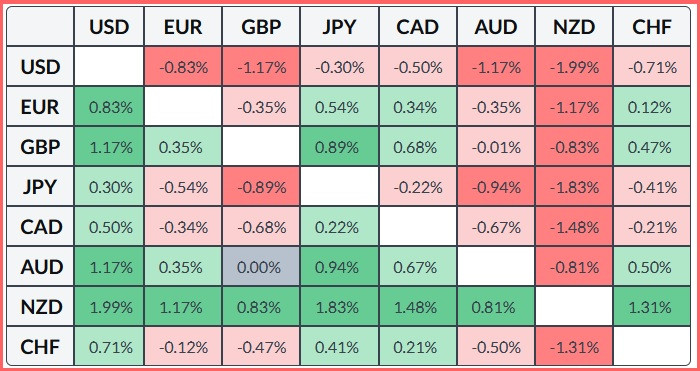

The table below shows the percentage change in the US dollar against major currencies for the week. The dollar has shown the greatest strength against the Japanese yen.