Toyota Industries Corp plánuje přijmout nabídku Toyota Motor Corp, jejího předsedy Akio Toyody a dalších a připravuje oznámení svého záměru na začátek května, uvedla v pondělí agentura Kyodo.

Bloomberg News minulý měsíc informoval, že předseda Toyota Motor Toyoda navrhl akvizici dodavatele Toyota Industries v hodnotě 6 bilionů jenů (41 miliard dolarů).

V návaznosti na tuto zprávu Toyota uvedla, že zvažuje možné odkupení klíčového dodavatele dílů. Pokud by se tato transakce uskutečnila, jednalo by se o přelomovou událost pro japonský průmysl, která by transformovala nejvlivnější korporátní skupinu v zemi.

Toyota a Toyota Industries zatím na žádosti o komentář k zprávě agentury Kyodo nereagovaly.

Today, GBP/USD continues its winning streak for the fifth consecutive day, trading slightly below the 1.3200 round level. Traders are anticipating that UK Chancellor of the Exchequer, Rachel Reeves, will present the autumn budget later in the day. It is expected that the Chancellor will announce new tax increases amounting to tens of billions of pounds. This budget will serve as a significant test of investor confidence in government bonds and for lawmakers supporting increased spending on social programs. A more responsible fiscal policy could strengthen long-term confidence in UK assets, which in turn would provide moderate support to the pound.

It has been just over a year since tax increases of £40 billion (approximately $52.7 billion) were introduced, marking the largest one-time increase since the 1990s. Against the backdrop of a likely deterioration in the UK economic outlook and rising debt servicing costs, Rachel Reeves is now compelled to take additional measures to increase revenue.

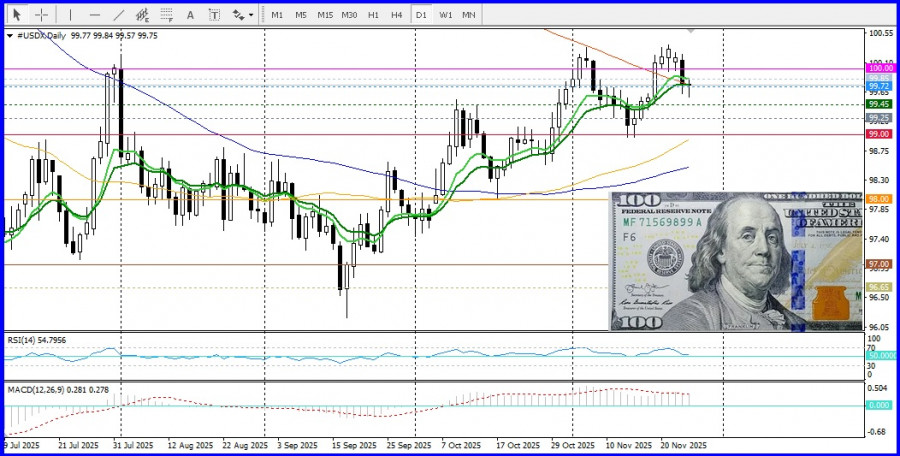

UK inflation fell to 3.6% in October, strengthening expectations of a Bank of England rate cut. Markets currently price in roughly an 80% probability of a 25 basis point rate cut in December, which has contributed to a decline in government bond yields ahead of the budget release. GBP/USD is also receiving support from a weakening US dollar. Weaker US economic data has intensified expectations for a December rate cut by the Federal Reserve. According to the CME FedWatch Tool, markets are currently pricing in an 84% probability of a 25 basis point Fed rate cut in December, up from just over 50% a week ago.

GBP/USD is also receiving support from a weakening US dollar. Weaker US economic data has intensified expectations for a December rate cut by the Federal Reserve. According to the CME FedWatch Tool, markets are currently pricing in an 84% probability of a 25 basis point Fed rate cut in December, up from just over 50% a week ago.

From a technical perspective, a break above the 100-SMA on the 4-hour chart favors the bulls. However, for a full bullish confirmation, they need to overcome the 200-SMA. On the daily chart, oscillators have not yet moved into positive territory, requiring caution for traders positioned for upward movement. Additionally, the 9-day EMA remains below the 14-day EMA, confirming short-term weakness among bulls. Resistance is at the 1.3200 round level, while support lies at the 14-day EMA near 1.3150. The next support is at the 1.3100 round level, with a stop at the 9-day EMA.