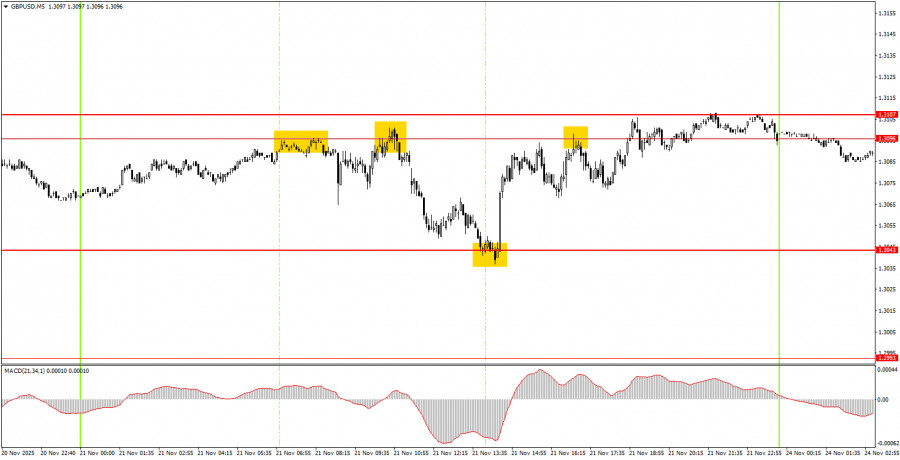

The GBP/USD pair traded in a new sideways channel on Friday. Recall that the price spent two weeks in the 1.3107-1.3203 channel and then settled below it, only to immediately become stuck in the next channel at 1.3043-1.3107. At the same time, a new downward trend has formed, as indicated by the trend line. As we can see, market movements remain far from the most attractive, but profit can still be made in a flat market. The illustration above shows that over two trading days, the price bounced off the boundaries of the new flat four times. Each of these opportunities allowed traders to open rebound trades. Regarding macroeconomic data, the British data again fell short. While the business activity indices showed results that were more or less acceptable, retail sales fell by 1.1% in October. Thus, the decline of the British currency was generally justified in the first half of the day. In the second half of the day, the decline in the American currency was triggered by the University of Michigan's consumer sentiment index.

On the hourly timeframe, the GBP/USD pair is forming a new downward trend. As we can see, the pair's movements have recently been difficult to label as entirely logical, even from a technical standpoint. As we mentioned, there are no global factors that would lead to a significant rise in the dollar in the long term; hence, we expect only upward movement in the medium term. However, the correction/flat on the daily timeframe is not yet over, and the local macroeconomic environment continues to weigh on the British pound.

On Monday, novice traders might expect new trading signals to form in the 1.3096-1.3107 range. A price bounce from this area will allow for the opening of short positions targeting 1.3043, while a consolidation above this area will indicate long positions targeting 1.3203.

On the 5-minute timeframe, the following levels should be monitored: 1.2913, 1.2980-1.2993, 1.3043, 1.3096-1.3107, 1.3203-1.3211, 1.3259, 1.3329-1.3331, 1.3413-1.3421, 1.3466-1.3475, 1.3529-1.3543, and 1.3574-1.3590. On Monday, no significant events are scheduled in the UK or the U.S., so the likelihood of the flat and low volatility persisting throughout the day is high.

Important announcements and reports (always available in the news calendar) can significantly impact the movement of the currency pair. Therefore, during their release, it is recommended to trade with maximum caution or to exit the market to avoid sharp reversals against the preceding movement.

Beginners trading on the Forex market should remember that not every trade can be profitable. Developing a clear strategy and money management is key to long-term success in trading.