No macroeconomic reports are scheduled for Tuesday. Thus, it can be immediately assumed that high volatility and trending movements are unlikely today. In any case, the market continues to ignore most macroeconomic and fundamental information. We believe that traders are continuing to trade purely based on technical analysis. Both the euro and the pound have been correcting for several months against the global upward trend. Perhaps now is the time to resume it.

There are quite a few fundamental events scheduled for Tuesday, but look at the movements of both currency pairs! There is practically none. The British pound is flat, and the euro moves within 40-50 pips at best throughout the day. It is unlikely that the speeches of European Central Bank or Federal Reserve representatives will change the situation. Remember that the speeches of officials from the ECB currently carry little significance. The ECB has completed its monetary policy easing cycle and is unlikely to change rates in the coming year. In any case, profound changes in inflation are needed to expect any adjustments.

The speeches of representatives from the Bank of England and the Fed are more important, as the market does not yet know what decisions will be made at the last meeting of the current year. The BoE will likely lower the key rate, while the Fed will keep it at the same level.

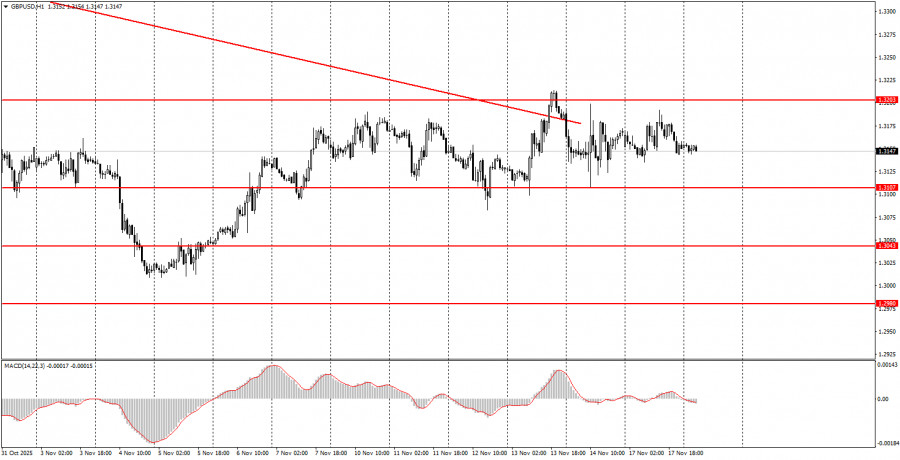

During the second trading day of the week, both currency pairs may continue moving sideways. The euro has a good trading range of 1.1571-1.1584. The British pound has two relevant trading ranges for Monday – 1.3096-1.3107 and 1.3203-1.3211.

Important announcements and reports (always available in the news calendar) can significantly impact the movement of the currency pair. Therefore, during their release, it is recommended to trade with maximum caution or to exit the market to avoid sharp reversals against the preceding movement.

Beginners trading on the Forex market should remember that not every trade can be profitable. Developing a clear strategy and money management is key to long-term success in trading.