Softwarová společnost ServiceNow (NYSE:NOW) Inc. prochází reorganizací svého nejvyššího vedení v oblasti prodeje, kdy společnost opouští dva vedoucí pracovníci. Podle agentury Bloomberg, která cituje mluvčího společnosti ServiceNow, potvrdili svůj odchod Erica Volini, výkonná viceprezidentka, a Ulrik Nehammer, předseda mezinárodního obchodu.

Mluvčí uvedl, že tyto změny jsou součástí běžného provozního rytmu společnosti, která rozhoduje o budoucím směřování svých obchodních a marketingových organizací s cílem přejít do další fáze růstu ServiceNow.

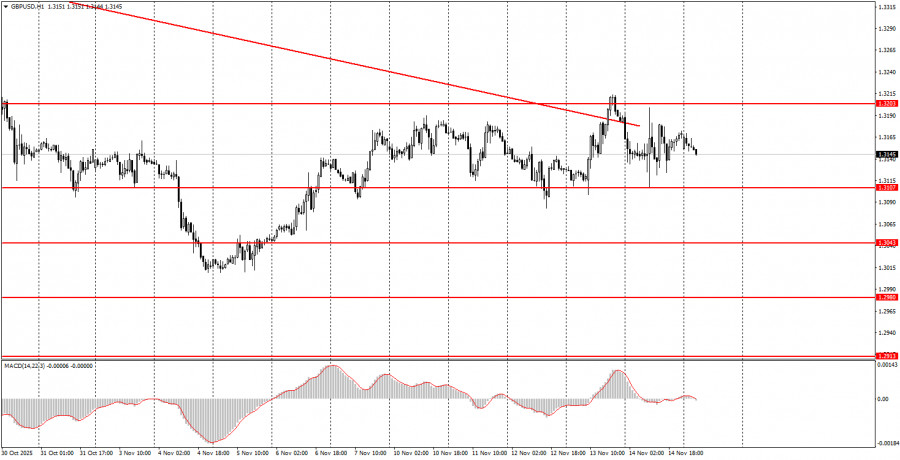

No macroeconomic reports are scheduled for Monday. Therefore, it can be immediately assumed that high volatility and trending movement are unlikely to be expected today. Overall, the market continues to ignore much of the macroeconomic and fundamental information. We believe that traders are still trading purely based on technical analysis. Both the euro and the pound have been correcting for several months against the global upward trend. It may be time to resume that trend now.

Several fundamental events are scheduled for Monday. The European Central Bank will hear speeches from Vice President Luis de Guindos and Chief Economist Philip Lane. These may seem like important events, but there are currently no questions from the market regarding the ECB's monetary policy. The ECB continues to maintain the key interest rate from meeting to meeting, as there is no need for any changes.

Regarding the Federal Reserve, John Williams, Philip Jefferson, Neel Kashkari, and Christopher Waller will speak today. It is worth remembering that last week several members of the Monetary Committee expressed strong opposition to a rate cut in December. The more members of the Committee shift to the proverbial "hawkish" side, the lower the likelihood of new easing at the next meeting will be. This factor could support the dollar, but last week it had no impact on market sentiment.

During the first trading day of the week, both currency pairs may continue to move sideways. The euro has a great trading area at 1.1571–1.1584. For the British pound, two relevant trading areas for Monday are 1.3096–1.3107 and 1.3203–1.3211.

Important announcements and reports (always available in the news calendar) can significantly impact the movement of the currency pair. Therefore, during their release, it is recommended to trade with maximum caution or to exit the market to avoid sharp reversals against the preceding movement.

Beginners trading on the Forex market should remember that not every trade can be profitable. Developing a clear strategy and money management is key to long-term success in trading.