Britská luxusní značka Burberry ve středu oznámila, že v rámci snahy o snížení nákladů a oživení podnikání propustí celosvětově 1 700 zaměstnanců, zatímco upravený provozní zisk za celý rok končící 29. březnem překonal očekávání.

Burberry, která se nachází v rané fázi plánu na obrat vedeného generálním ředitelem Joshuou Schulmanem, těsně unikla ztrátě za finanční rok 2025 s upraveným provozním ziskem 26 milionů liber (34,55 milionu dolarů), čímž překonala odhady analytiků ve výši 11 milionů liber.

Schulman převzal vedení společnosti loni a změnil strategii a marketing Burberry tak, aby se více zaměřila na trenčkoty a šály poté, co značka utrpěla ztráty v důsledku chybných produktových rozhodnutí, nadměrného zvyšování cen a obecného poklesu poptávky po luxusním zboží.

Srovnatelné tržby ve čtvrtém čtvrtletí poklesly o 6 %, což je lepší výsledek než průměrný odhad analytiků, kteří předpokládali pokles o 7 %.

„S zlepšením vnímání značky budeme zvyšovat frekvenci a dosah našich kampaní, jakmile se do obchodů dostanou naše podzimní a zimní kolekce,“ uvedl Schulman v prohlášení.

Tržby v Americe a v regionu Evropy, Středního východu, Indie a Afriky poklesly oproti loňskému roku o 4 %, zatímco tržby v Asii a Tichomoří poklesly o 9 %.

Horší výhled pro spotřebitelské výdaje v USA může představovat výzvu pro Schulmanovo zaměření na americké zákazníky s cílem zvýšit tržby Burberry.

Burberry se ve svém prohlášení konkrétně nezabývalo americkými cly, ale uvedlo, že „geopolitický vývoj“ zvyšuje nejistotu ekonomiky, a nestanovilo konkrétní cíle pro finanční rok 2026.

Overheating is the best term to describe the situation in the US stock market at the beginning of November. Following an explosive jump of more than 40% from the April lows, the S&P 500 has pulled back. The broad market index weighs the pros and cons of continuing its upward march. The artificial intelligence sector is a powerful bullish driver, but much of its potential has already been factored into prices. Moreover, investors are plagued by doubts about whether the massive investments in AI will yield satisfactory returns.

Dynamics of AI investment loans

From a fundamental viewpoint, the S&P 500 is clearly overvalued. Today's stock market bears similarities to the early 2000s, when internet companies soared only to meet a tragic end. All bubbles burst with a bang, yet there are many bad days when they inflate. In January 2000, the Nasdaq fell by 3% over five trading days, but investors bought the dip, hoping for market perfection. Ultimately, before its crash in March that year, the index had surged by 28%.

In reality, that January peak was a warning signal. The pullback in early November may serve as another warning. The modern stock market is also viewed as a paragon of perfection. Thus, doubts about potential interest rate cuts by the Fed, high fundamental valuations, and rising yields on US Treasury bonds are often overlooked. Nevertheless, signs of overheating are evident.

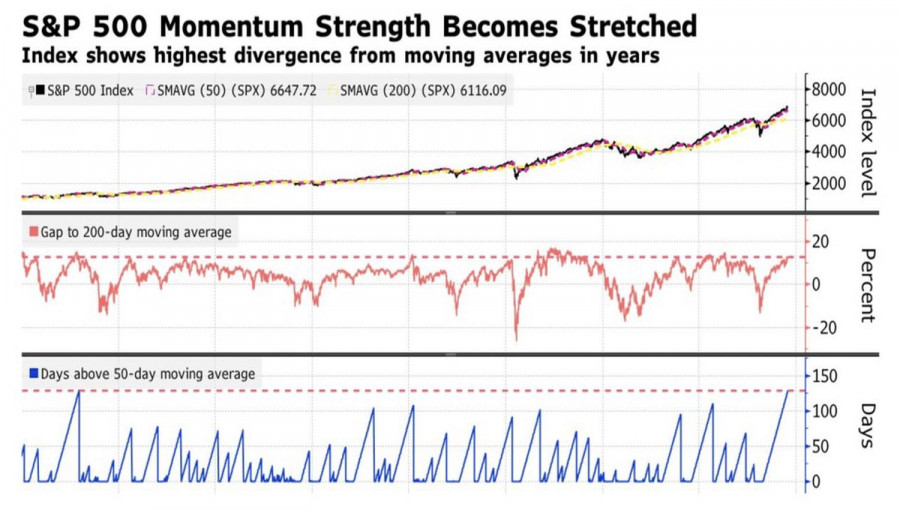

S&P 500 dynamics, gaps with EMA, and duration above EMA

The gap between the S&P 500 and its 200-day moving average has increased to 13%. Historically, such spreads are unsustainable. Over time, they tend to narrow through corrections. The broad market index has traded above the 50-period EMA for the longest stretch since 2011. While these signs of overheating do not predict an impending pullback, they do prompt investors to stay alert. Doubts are arising in the market regarding the effectiveness of the dip-buying strategy, which has proven successful since April.

On the other hand, the market continues to find positivity even in the negative. The S&P 500 was not discouraged by the fact that the probability of a federal funds rate cut in December fell from 74% to 62% after the release of strong services sector activity data from ISM and employment figures from ADP. The Fed has a dual mandate, and even if the US economy appears healthy while the labor market cools, the central bank will still look to ease monetary policy.

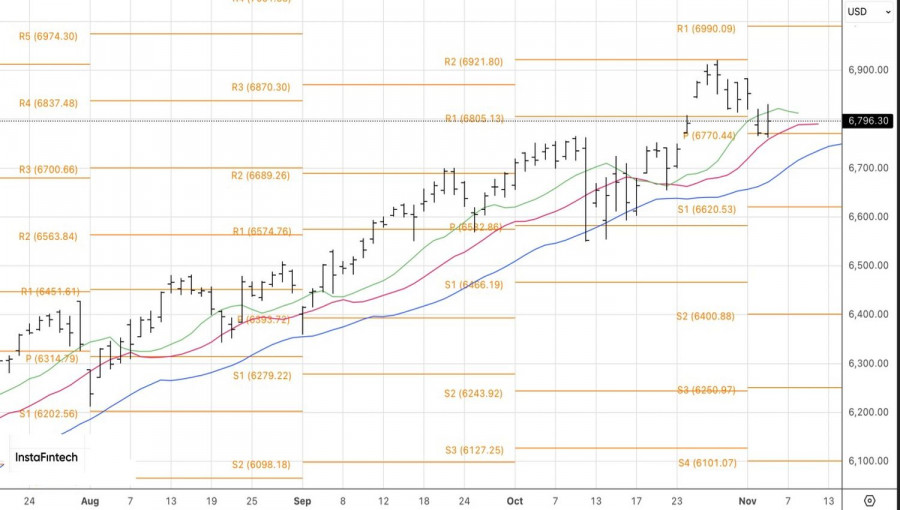

Technical outlook

Technically, on the daily chart, the S&P 500 is testing the first of three moving averages that make up Bill Williams' Alligator. A return to the breakout bar's high of 6,830 will serve as a basis for purchases within Linda Raschke's Holy Grail strategy. Conversely, a decline of the broad market index below the pivot level of 6,770 would signal the formation of short positions.