Is there reason to panic when corporations are as strong as a bull, the U.S. economy is expanding, and the Federal Reserve plans to continue cutting rates? Positive earnings reports from Intel and other companies acted as a catalyst for a swift rebound in the S&P 500 from its local bottom. Investors did what they had been wanting to do for some time—buy the dip. Are record highs just around the corner?

According to LSEG data, out of 130 S&P 500 companies that have reported third-quarter results, 86% have exceeded profit forecasts. This figure not only reflects their robust health but also a firmly grounded U.S. economy. Moreover, signs of improvement are giving strength to stock buyers.

New home sales rose at the fastest pace in seven months. Manufacturing activity in the central U.S. has expanded for four consecutive months after three years of contraction. Consumer spending via credit cards at the six largest banks increased by 7.5% in July–September, significantly outpacing inflation.

Goldman Sachs notes that financial conditions are currently the most favorable for the economy since spring 2022, and a leading indicator from the Atlanta Fed projects U.S. GDP growth accelerating to 3.9% in the third quarter.

If we add to this the Fed's clear intention to lower rates, it becomes easier to believe in a soon-to-be-restored uptrend for the S&P 500. Indeed, futures markets are pricing in a 99% likelihood of monetary easing in October and 92% in December.

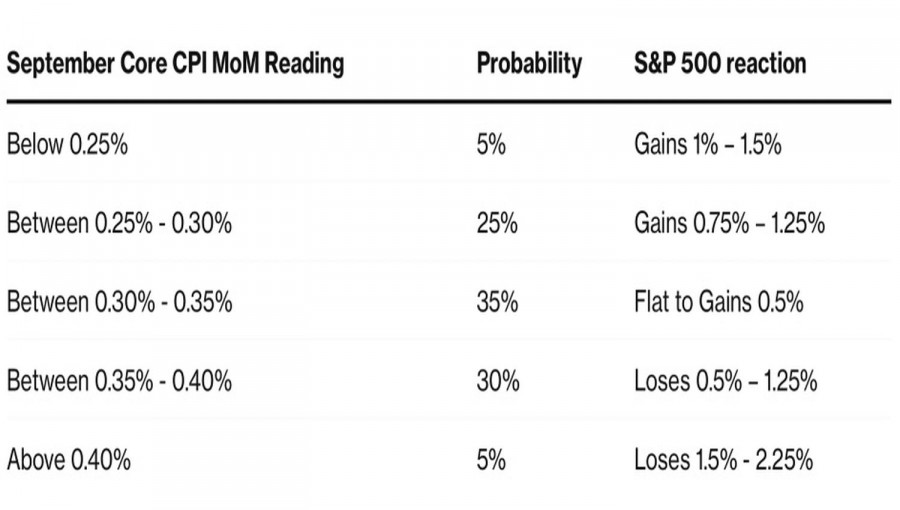

Investors believe that even an acceleration in U.S. consumer prices in September will not deter the Fed from its path of monetary policy easing. For example, JP Morgan sees a 65% chance that the S&P 500 will rise following the release of inflation data.

It would be wrong to say that all storm clouds over the S&P 500 have cleared. The U.S. and China continue to escalate tensions during trade negotiations. Washington has initiated an investigation into China's compliance with its agricultural purchase commitments from the first trade war. Back then, Beijing refused to fulfill them, citing the pandemic's negative impact.

Donald Trump demands that China loosen export controls on rare earth minerals, increase imports of U.S. soybeans, and block fentanyl shipments into the U.S. In exchange, he promises to extend relatively low tariffs. However, China is holding on to its trump cards. Letting go of them would mean defeat.

The positions of both sides are far apart, suggesting difficult negotiations ahead. Markets seem to be underestimating the risks of a trade war, and a sharp rise in inflation could trigger another wave of sell-offs in the broad stock index.

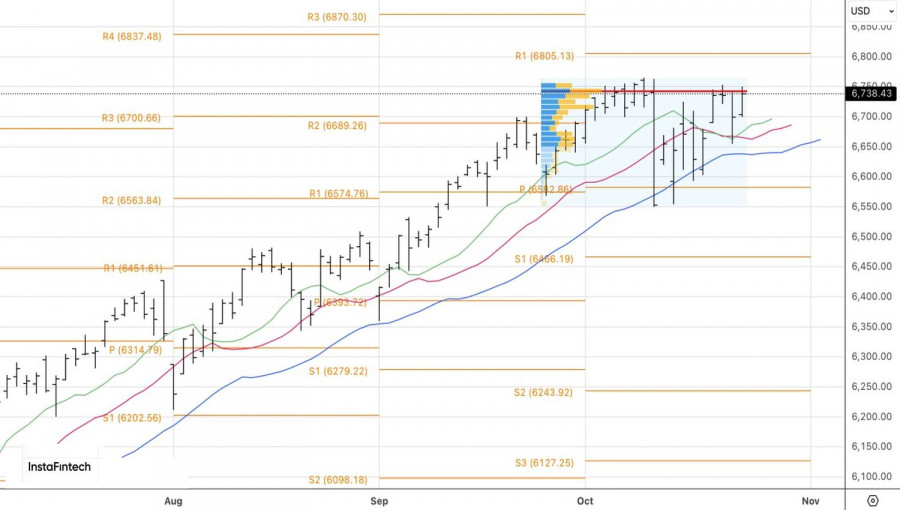

Technically, on the daily S&P 500 chart, a battle is unfolding for the fair value at 6745. A victory for the bulls would open the door to previous long-term targets at 6800 and 6920. Conversely, a defeat would justify selling toward 6650 and 6585.