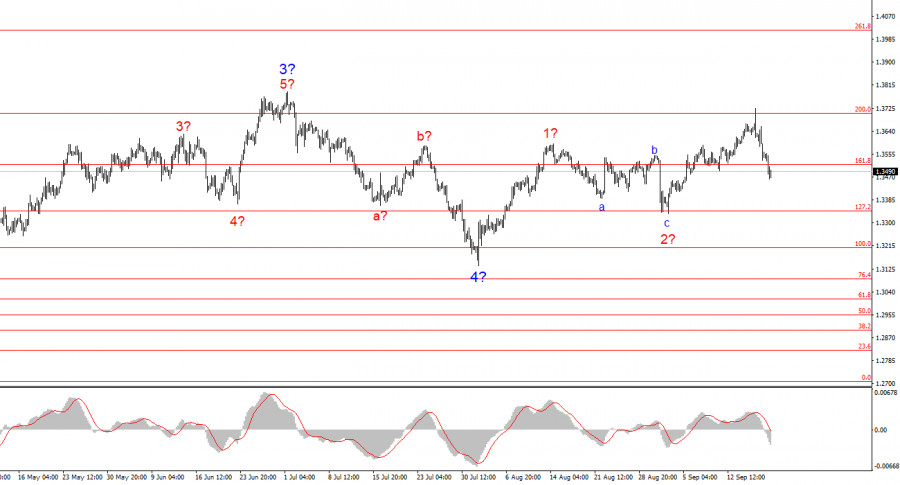

First and foremost, the wave structure should be considered. Does it show signs of a trend reversal? The answer is simple – no. The British pound has formed another five-wave sequence, after which it moved into a correction. Therefore, wave analysis still forecasts further strengthening of the pound. Perhaps the pound does not have much time left to rise, but this will depend not on UK news, but on US news, since the scale of America's problems is much greater than those in Britain.

The pound has been actively declining over the past few days, surprising many in the market. This week the Bank of England and the Fed held meetings, and their outcomes could have pleased buyers—or at least not disappointed them. In short, the Fed has embarked on a course of monetary policy easing. By the end of the year, the US regulator may cut rates twice more, and next year Jerome Powell will leave his post, making way for another of Trump's "own people." Perhaps some other members of the FOMC will "voluntarily" resign or be labeled "fraudsters." Therefore, next year "dovish" expectations may become even stronger.

The Bank of England will likely also continue cutting rates over time, but the pace of easing will be much slower than at the Fed. That is why the pound, like the euro, still looks much more attractive than the dollar, and this week's news background should rather have triggered renewed selling of the US currency. For the first time in a long while, most UK statistics did not disappoint, while the bulk of September's US reports could only cause tears and sadness.

But on Friday it became known that UK Treasury borrowing in August exceeded all conceivable forecasts. The budget deficit is enormous, and it is unclear how it will be covered. The drafting of next year's budget is just ahead, but there is not enough money, and new loans will have to be taken at fairly high rates. It was precisely market fears regarding the UK budget that reduced demand for the pound at the end of the week, despite generally positive results for the pound from both the BoE and Fed meetings.

However, in my view, the pound's decline will be short-lived. In the US, as I have said, the problems are far more serious, and the Fed's "dovish" actions by year-end will outweigh any negativity from the UK. Analysts note that short positions on the dollar continue to increase, so I regard the GBP/USD decline as a corrective wave fully consistent with the current wave structure.

Based on the analysis of EUR/USD, I conclude that the instrument continues to build an upward segment of the trend. The wave pattern still entirely depends on the news background tied to Trump's decisions and the domestic and foreign policy of the new US administration. The targets of the current segment may extend as far as the 1.25 level. The news background remains unchanged, so I continue to stay in long positions, despite the first target around 1.1875 (161.8% Fibonacci) having already been reached. By year-end, I expect the euro to rise to 1.2245, corresponding to the 200.0% Fibonacci level.

The wave structure of GBP/USD remains unchanged. We are dealing with an upward impulsive segment of the trend. Under Donald Trump, markets may face numerous shocks and reversals that could significantly affect the wave picture, but for now the working scenario remains intact, and Trump's policy is unchanged. The targets of the upward segment are located around the 261.8% Fibonacci level. At present, I expect the pair to continue rising within wave 5, aiming for 1.4017.

Key principles of my analysis: