WASHINGTON (Reuters) – Republikáni v americkém Kongresu plánují předložit rozsáhlý balíček opatření v oblasti obrany v hodnotě 150 miliard dolarů, který poskytne počáteční podporu ve výši 27 miliard dolarů na kontroverzní projekt protiraketového štítu Golden Dome prezidenta Donalda Trumpa, jak vyplývá z dokumentu a informací od asistenta kongresmana.

There are quite a few macroeconomic releases scheduled for Friday, and almost all of them are important or at least relatively so. Of course, the primary focus will be on the US NonFarm Payrolls and the unemployment rate. These data will determine the Federal Reserve's decision at its September 16-17 meeting. If unemployment rises and Nonfarms once again come in below forecasts, the Fed will be almost certain to cut its key interest rate. This, in turn, could trigger the dollar's decline, which we've been anticipating for about two weeks. Among other reports, UK retail sales, Eurozone GDP, and US wage figures are worth highlighting. However, we believe that market reaction to these will be weak or nonexistent.

There's absolutely nothing to note among Friday's fundamental events—but today, they won't be needed anyway. Traders will have enough macroeconomic data at their disposal to make forward-looking decisions. Let's recall that, in any case, the Fed is almost certain to start cutting rates. The only question is how quickly rates will be lowered over the next year to year-and-a-half. Therefore, during all this time, the US currency will be under significant fundamental pressure. We should also not forget the ongoing trade war, as its persistence means we cannot see what could create demand for the dollar. As a bonus, let's add Trump's pressure on the Fed to the list of factors weighing on the dollar. The US President clearly wants to change half of the FOMC, which threatens the Fed's independence and could further undermine confidence in the US dollar.

On the last trading day of the week, both currency pairs may attempt to continue their growth. However, volatility this week is extremely low, and trending movement is virtually absent. Thus, we do not expect movement before the publication of US data. What happens after the US labor market and unemployment reports are released will depend on the nature of those reports.

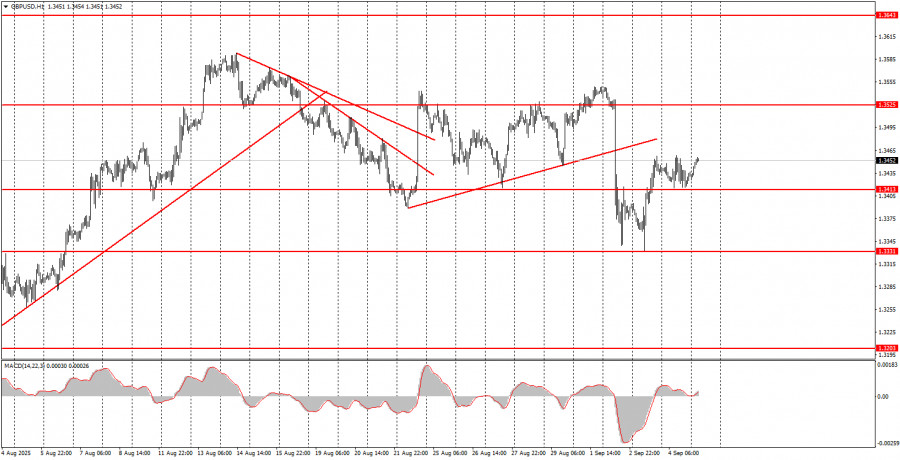

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.