The first test of the 1.3445 price occurred when the MACD indicator had already moved significantly above the zero line, which limited the pair's upside potential. The second test of 1.3445 coincided with the MACD being in the overbought zone, triggering Sell Scenario #2; however, as you can see on the chart, a decline in the pair never materialized, resulting in losses being locked in.

Yesterday, New York Fed President John Williams stated that next month's US central bank policy meeting will be rather lively, hinting at a possible rate cut. This immediately led to a drop in the dollar and an appreciation in the pound. Williams' statement acted as a catalyst for the market to reassess expectations regarding the Fed's next moves. Investors, who had previously leaned toward rates remaining unchanged, are now actively factoring in the likelihood of monetary policy easing. A rate cut is seen as a way to support economic growth amid global uncertainty and trade tensions.

Today, there's no UK data scheduled, so pound buyers will have a chance to extend this week's gains, supported by overall dollar weakness and positive sentiment. However, don't forget the fundamental backdrop for the pound remains complicated, and any positive momentum might be short-lived.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

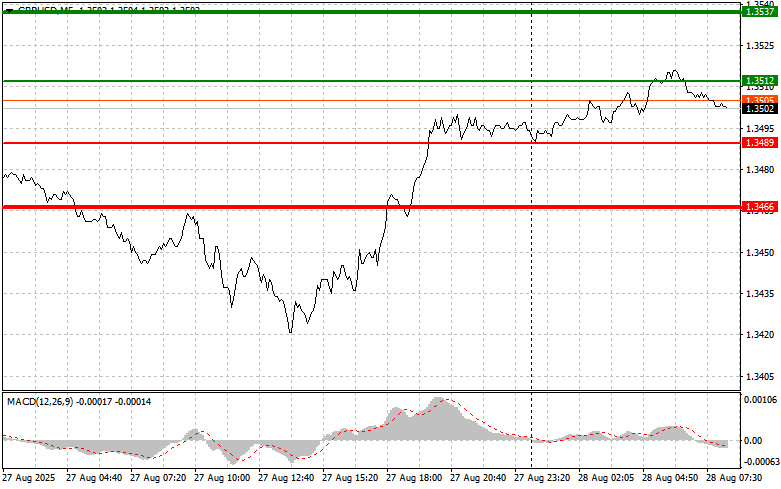

Scenario #1: Today, I plan to buy the pound if the entry point at 1.3512 (indicated by the green line on the chart) is reached, targeting a rise to 1.3537 (the thicker green line). Around 1.3537, I plan to exit buys and open shorts in the opposite direction (expecting a move of 30–35 pips from the entry level). A rise in the pound today should be considered only within yesterday's uptrend. Important! Before buying, ensure the MACD indicator is above zero and is just starting to rise from this level.

Scenario #2: I also plan to buy the pound today in the event of two consecutive tests of 1.3489 while the MACD is in oversold territory. This should limit the pair's downside and lead to an upward reversal. A rise toward the opposite levels of 1.3512 and 1.3537 can be expected.

Scenario #1: Today, I plan to sell the pound after a move below 1.3489 (red line), which could lead to a quick drop in the pair. The key target for sellers will be 1.3466, where I'll exit shorts and immediately buy in the opposite direction (aiming for a 20–25 pip reversal). Sellers are unlikely to act aggressively today. Important! Before selling, ensure the MACD is below zero and is just starting to decline from this level.

Scenario #2: I also plan to sell the pound today in the event of two consecutive tests of 1.3512 while the MACD is in the overbought zone. This will cap the pair's upside and result in a reversal downward. A decline toward the opposite levels of 1.3489 and 1.3466 can be expected.

Thin green line – entry price at which the instrument can be bought.

Thick green line – suggested price for taking profit or manually securing profits, as further growth above this level is unlikely.

Thin red line – entry price at which the instrument can be sold.

Thick red line – suggested price for taking profit or manually securing profits, as further decline below this level is unlikely.

MACD indicator: When entering the market, it is important to refer to overbought and oversold areas.

Important. Beginner forex traders should exercise extreme caution when making entry decisions. Before important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during the release of news, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes. And remember: for successful trading, you need a clear trading plan, as I described above. Making spontaneous trading decisions based on the current market situation from moment to moment is a losing strategy for an intraday trader.