The EUR/USD currency pair traded in an ultra-calm manner on Monday, just as it did on Friday. Despite global-scale events in Alaska, the market continues to behave extremely quietly, reacting only to economic data and economic developments. And there have been none in recent days. As for macroeconomic data from overseas published on Friday, it did not attract traders' attention at all — just as expected. Reports on industrial production and consumer sentiment turned out predictably weak, while the market ignored retail sales.

The dollar remains at the forefront of the battlefield. It feels as though it has been brought onto the stage, tied to a post, and the audience is free to throw whatever they want at it — or even shoot at it. If you have a tank, you can fire from that, too. Practically all the news entering the information space in one way or another hits the dollar. Therefore, in our view, any strengthening of the U.S. currency is nothing more than a routine pullback.

It should be remembered that technical corrections vary depending on the timeframe. For example, not long ago, the dollar appreciated for an entire month. During that period, some news did indeed occasionally come in positive for it. However, we believe that was not the main reason behind its growth. Corrections are needed even on the daily timeframe. But how can they occur if most news is negative for the U.S. currency?

Thus, the fact that the dollar has not fallen in the past few days should not be misleading. Perhaps a settlement of the conflict between Ukraine and Russia will not weigh on the U.S. currency. Perhaps no settlement will happen at all, as European leaders do not want the war to end. They want to continue exerting pressure on Russia by all possible means, buying time for themselves. Yet even without this factor, the dollar will continue to show weakness.

Just consider: the Federal Reserve is ready to cut the key rate for the first time since 2024. The trade war not only shows no signs of ending but continues to escalate. Donald Trump wants complete control over the Fed and the Bureau of Statistics, and these are not empty words. We fully admit this is Trump's objective. If so, achieving it is just a matter of time, since Trump typically does not retreat from his goals.

Thus, 2025 for the dollar may be just "the beginning." In 2026, a new person will come to power at the Fed, and with 90% probability, will follow orders from the White House. After that, the rate could fall to 1–2%. Imagine where the dollar might sink with such a rate, especially considering that Trump himself wants the cheapest dollar possible to boost exports. In other words, no one will be saving the U.S. currency — which had been appreciating for 17 consecutive years — from depreciation. Moreover, it is worth noting the decline in trust in the dollar as a hedging instrument since Trump took office.

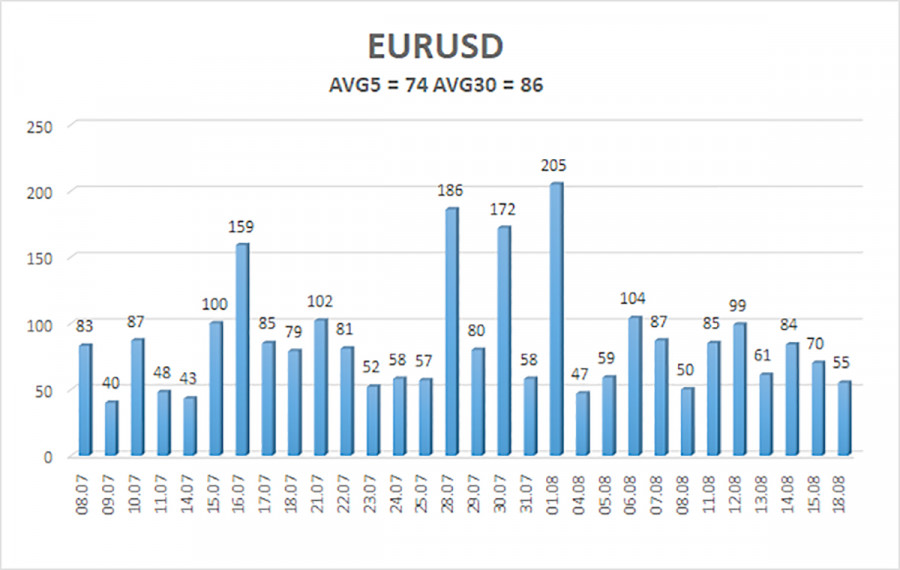

The average volatility of the EUR/USD currency pair over the last five trading days, as of August 19, is 74 pips, which is characterized as "moderate." We expect the pair to move between the levels of 1.1591 and 1.1739 on Tuesday. The long-term linear regression channel points upward, still indicating an uptrend. The CCI indicator entered the oversold zone three times, signaling the resumption of the upward trend.

S1 – 1.1658

S2 – 1.1597

S3 – 1.1536

R1 – 1.1719

R2 – 1.1780

R3 – 1.1841

The EUR/USD pair may resume its upward trend. The U.S. currency continues to be strongly influenced by Trump's policies, and he does not intend to "stop where he is." The dollar has risen as much as it could, but now it seems the time has come for a new prolonged decline. If the price is positioned below the moving average, small short positions may be considered with targets at 1.1597 and 1.1536. Above the moving average line, long positions remain relevant with targets at 1.1719 and 1.1739 in continuation of the trend.

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.