What comes first, the chicken or the egg? Is Bitcoin merely following US stock indexes and risk appetite? Or will the plunge in BTC/USD serve as a warning sign for the S&P 500? Is the US stock market on the verge of a rout? The latest crypto sell-off seems to suggest so.

After hitting a record high, Bitcoin tumbled sharply, losing nearly 4% of its value within moments. The BTC/USD retreat pushed the crypto market's capitalization back below the psychologically important $4 trillion mark. The sell-off was driven by Treasury Secretary Scott Bessent's comments and a surge in US producer prices to a three-year high.

Following Congress's approval of a stablecoin bill, digital assets seemed to gain full backing from the White House. Earlier, Donald Trump stated that the US would pursue budget-neutral strategies to build up its crypto reserves. Investor confidence in this expansion had been propelling BTC/USD higher. Bessent's remarks, however, came as a cold shower for the bulls.

Bessent stressed that the White House has no plans to buy Bitcoin. However, it will hold confiscated tokens and has no intention of selling them. All of this falls within Trump's pledge to turn the US into the crypto capital of the world.

Bitcoin–equity correlation dynamics

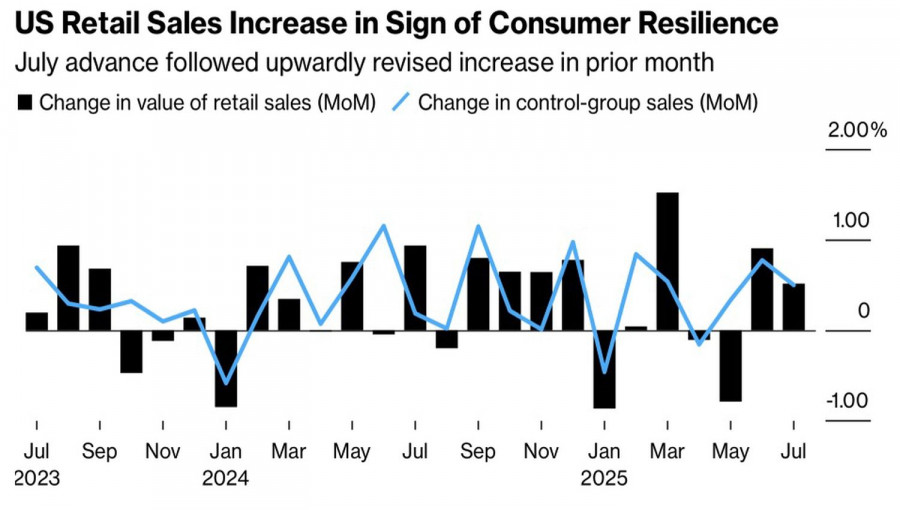

The cold shower from the Treasury Secretary, coupled with the acceleration in producer prices and strong US retail sales data, forced BTC/USD bulls to retreat. Odds of a September Fed rate cut dropped from nearly 100% to 85%. Yet the S&P 500 did not meaningfully pull back from record highs. If it does so later, Bitcoin may start to be viewed as a leading indicator.

The broad equity index has retail investors—or the so-called "crowd"—buying the dips. But does crypto? In the digital asset market, dominance has been shifting from crypto whales to large institutional players. These include corporate treasuries led by Michael Saylor's Strategy, as well as specialized exchange-traded funds (ETFs). Their growing share makes dip-buying in crypto more complex.

US retail sales dynamics

In my view, the S&P 500 has gone too far. Excessively high valuations and multiple vulnerabilities increase the risk of a correction in the broad equity index. Such a pullback would almost certainly drag BTC/USD lower as well. Bitcoin's inability to hold near record highs is already the first sign of buyer weakness.

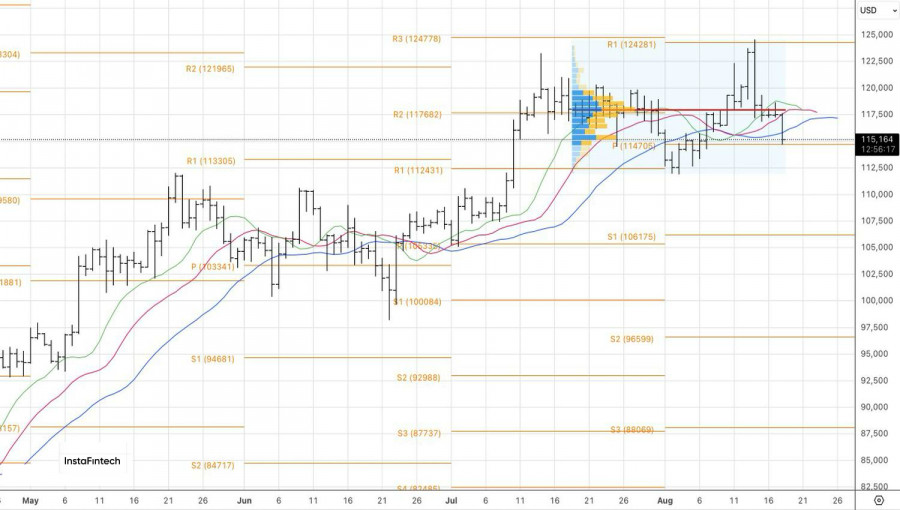

Technically, on the daily chart of the leading cryptocurrency, a reversal pattern known as Anti-Turtles has formed. A drop in BTC/USD below the bar low at point 1—or 119,000 under classic rules—provided grounds for short positions. A fresh trigger for selling would be a successful break below pivot support at 114,750.