Prezidentka Federálního rezervního systému v San Francisku Mary Dalyová v pátek uvedla, že ačkoli jí stále vyhovuje několik snížení úrokových sazeb v letošním roce, rostoucí rizika inflace znamenají, že centrální banka možná bude muset udělat méně, zejména vzhledem k tomu, že nejistota ohledně obchodní politiky prezidenta Donalda Trumpa zatím příliš nenarušila stále solidní růst americké ekonomiky.

„Pokračovat v postupném snižování základní úrokové sazby bez naléhavé potřeby rychlé reakce je správné,“ řekla na akci pořádané Fisherovým centrem pro nemovitosti a městskou ekonomiku Kalifornské univerzity v Berkeley. „Nakonec jsme Američanům dali jediný slib – myslím, že si všichni pamatujete, jaký to byl – obnovíme cenovou stabilitu. To je rozhodující základ všech dalších věcí, které děláme.“

Fed od prosince drží základní úrokovou sazbu stabilně v rozmezí 4,25-4,50 %. Tvůrci politiky obecně uvádějí, že sazby pravděpodobně zvýší inflaci a zpomalí ekonomiku. Mnozí z nich, včetně předsedy Fedu Jeroma Powella, říkají, že chtějí počkat, co se skutečně stane v oblasti obchodu a dalších politik, než provedou nějaké úpravy, což je názor, který přijal i Daly.

Trade Review and Trading Tips for the Euro

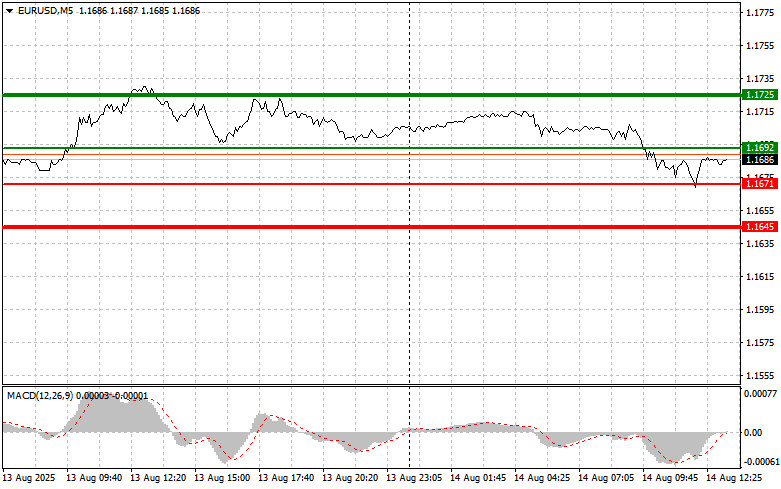

The price test of 1.1695 coincided with the moment when the MACD indicator had just started moving down from the zero mark, confirming a correct sell entry for the euro and resulting in a 30-point drop in the pair. Buying on a rebound from 1.1669 also yielded about 15 points of profit.

The euro's decline followed the release of disappointing Q2 GDP data for the euro area. The slowdown in Europe's economic growth is becoming increasingly evident, which may prompt the European Central Bank to shift back toward a more accommodative monetary policy, even though many analysts have recently leaned toward the view that the ECB's easing cycle is complete.

The second half of the day will be event-heavy, with the release of U.S. initial jobless claims, the Producer Price Index (PPI), and a speech by FOMC member Thomas Barkin. These factors may trigger volatility in the currency markets and provide important insights for assessing the U.S. economy and the Federal Reserve's plans. Weak jobless claims data could heighten concerns over slowing U.S. economic growth. The PPI is also a key indicator of inflationary pressure; an increase may indicate persistent inflation and the need for continued tight policy. Barkin's remarks will give an idea of sentiment within the Federal Open Market Committee and how the Fed views the current economic situation and its future policy steps. Recently, however, many policymakers have refrained from taking a clear stance, citing the need for more data.

As for the intraday strategy, I will mainly rely on scenarios #1 and #2.

Buy Signal

Scenario #1: Today, euro purchases can be considered around 1.1692 (green line on the chart) with a target at 1.1725. At 1.1725, I plan to exit the market and also open a short position, expecting a 30–35-point move from the entry level. A strong euro rise today will be possible if the uptrend continues after weak U.S. statistics. Important: Before buying, make sure the MACD indicator is above the zero mark and just starting to rise from it.

Scenario #2: I also plan to buy the euro if there are two consecutive tests of 1.1671 while the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a reversal upward. A rise toward the opposite levels of 1.1692 and 1.1725 can be expected.

Sell Signal

Scenario #1: I plan to sell the euro after the price reaches 1.1671 (red line on the chart), targeting 1.1645, where I will exit the market and immediately open a long position, expecting a 20–25-point move in the opposite direction. Downward pressure on the pair will return if the statistics are strong. Important: Before selling, make sure the MACD indicator is below the zero mark and just starting to decline from it.

Scenario #2: I also plan to sell the euro if there are two consecutive tests of 1.1692 while the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a reversal downward. A decline toward the opposite levels of 1.1671 and 1.1645 can be expected.

Chart Legend:

Important: Beginner Forex traders should be very cautious when deciding to enter the market. Before the release of key fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during news releases, always place stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you ignore money management and trade large volumes.

Remember, successful trading requires a clear trading plan, like the one provided above. Making spontaneous decisions based on the current market situation is inherently a losing strategy for intraday traders.