Scheduled Maintenance

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

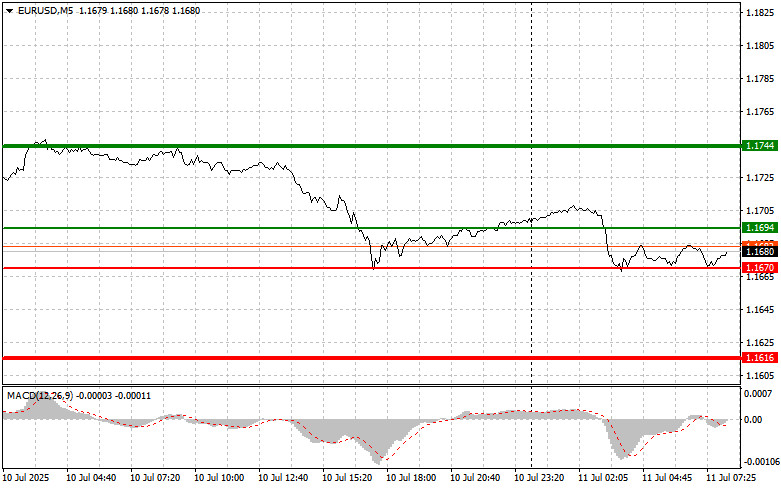

The price test of 1.1725 occurred at the moment when the MACD indicator had just begun to move downward from the zero line. This confirmed the validity of the euro short entry and resulted in a drop of more than 40 points.

The threat of another 35% tariff from the U.S. on countries that have not signed trade agreements supported the U.S. dollar and triggered a sharp decline in risk-sensitive assets, including the euro.

Today, despite the lack of significant eurozone-wide news, the focus will be on Germany and France. Investors are closely watching the release of Germany's Wholesale Price Index (WPI) and France's Consumer Price Index (CPI), as both reports provide insight into the inflation outlook for the largest eurozone economies. Germany's WPI is traditionally seen as a leading inflation indicator, as rising wholesale prices may eventually translate into higher consumer prices. Conversely, a decline in WPI could signal weakening inflationary pressure and potentially lower prices for consumers.

Later, France's CPI will be published. This index reflects changes in the prices of goods and services purchased by households. An increase in CPI may push the ECB to maintain a cautious stance on interest rates, while a decline could prompt the central bank to maintain or even ease current policy.

As for the intraday strategy, I will primarily rely on Buy Scenario #1 and #2.

Buy Scenarios

Scenario #1: A long position in EUR may be considered if the price reaches the level around 1.1694 (green line on the chart), targeting a rise toward 1.1744. At 1.1744, I plan to exit the market and open a short position in anticipation of a 30–35 point downward move. Buying the euro today is more appropriate after the release of strong data.Important: Before entering a long trade, make sure that the MACD indicator is above the zero line and just starting to move upward.

Scenario #2: I also plan to buy the euro in the event of two consecutive tests of the 1.1670 level while the MACD is in the oversold zone. This would limit the downward potential and likely result in a market reversal to the upside. A rise toward 1.1694 and 1.1744 can then be expected.

Sell Scenarios

Scenario #1: A short position in EUR may be considered after the price reaches the 1.1670 level (red line on the chart), targeting a move to 1.1616, where I plan to exit and open a long trade in the opposite direction (aiming for a 20–25 point rebound). Pressure on the pair may return if the upcoming data turns out weak.Important: Before entering a short trade, make sure that the MACD indicator is below the zero line and just beginning to move downward.

Scenario #2: I also plan to sell the euro after two consecutive tests of the 1.1694 level while the MACD is in the overbought zone. This would cap the pair's upward potential and could trigger a downward reversal. A decline toward 1.1670 and 1.1616 is then likely.

Chart Legend:

Important Note:

Beginner Forex traders must be very cautious when making trade entry decisions. It's best to stay out of the market before the release of major fundamental reports to avoid sharp price swings. If you choose to trade during news releases, always use stop-loss orders to limit potential losses. Trading without stops—especially when using large volumes and lacking a money management strategy—can quickly lead to a total loss of capital.

And remember: successful trading requires a clear trading plan, like the one outlined above. Making spontaneous decisions based solely on current price movements is a losing strategy for intraday trading.

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.