Quite a few macroeconomic events are scheduled for Tuesday, but most are expected to have only a minor impact on the movement of both currency pairs. As a reminder, the market is still not particularly interested in macroeconomic data — it's focused on the development of the trade war. In recent weeks, signs of de-escalation have emerged, leading to a strengthening of the U.S. dollar. Today, the UK will release unemployment and wage reports, the Eurozone will publish economic sentiment data, and the U.S. will release April inflation figures. We believe that only the U.S. Consumer Price Index (CPI) can significantly influence the dollar's movement.

There's still little point in discussing fundamental events other than Trump's trade war. The conflict's escalation has been paused, and Trump continues to announce new trade agreements without providing concrete details. The dollar may resume its decline if Trump begins introducing new tariffs or increasing old ones, or fails to sign agreements with most of the involved countries. However, the ongoing de-escalation, which has already begun, should support the dollar's strengthening, as we saw on Monday.

Thus, future movements still depend entirely on Trump—or, more precisely, on the signing of trade deals and the reduction of tariffs he previously introduced.

On the second trading day of the week, both currency pairs may continue to decline, as the 115% reduction in tariffs between China and the U.S. is a very significant and positive development for the U.S. dollar. However, a consistent de-escalation of the trade war is essential for the dollar to fully recover after a three-month decline.

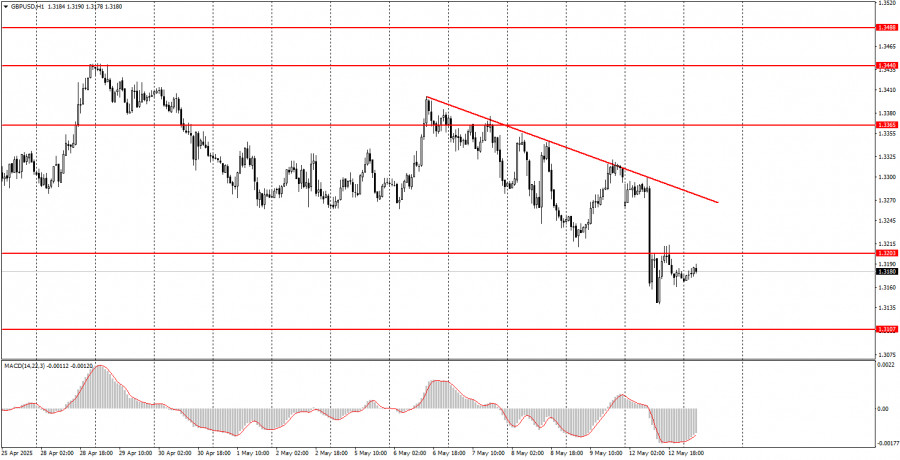

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.