Trade Analysis and Guidance for the British Pound

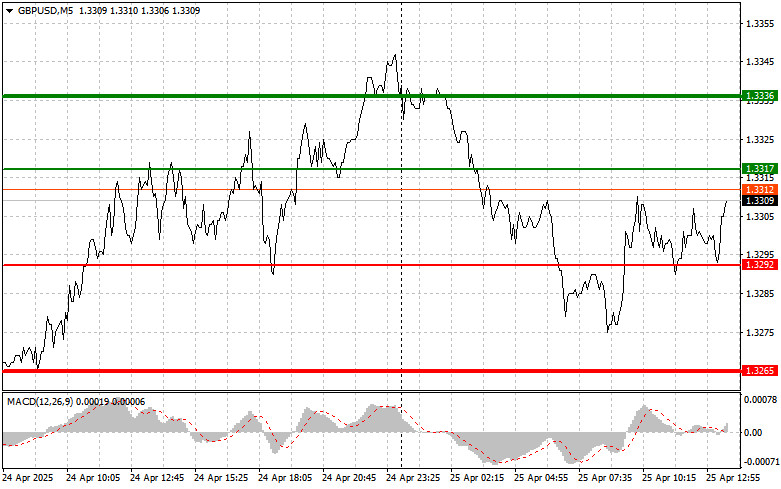

The price test at 1.3292 occurred when the MACD indicator had just started to move upward from the zero line, which confirmed the correct entry point for buying the pound and resulted in a 15-point increase.

Retail sales growth in the UK triggered a modest uptick in pound buying. The data was notably better than expected, indicating some resilience in consumer spending despite broader economic uncertainty. However, a single positive report is not enough to outweigh the range of factors restraining the pound's bullish momentum. These include persistent concerns about the UK's economic growth outlook. Despite some improvement in macroeconomic indicators, many analysts still forecast a recession in the coming quarters. This continues to pressure the Bank of England to lower interest rates further, ignoring the inflation risks stemming from U.S.-imposed tariffs.

In the second half of the day, the focus will shift to the University of Michigan Consumer Sentiment Index and inflation expectations. These indicators are likely to attract close attention from investors as they contain important insights about the future of the economy and the potential policy actions by the Federal Reserve. The Consumer Sentiment Index is a key indicator reflecting consumer confidence in the economy. A rising index typically indicates optimism about personal finances and a greater willingness to spend—positive for economic growth. On the other hand, a declining index may signal concerns about the economy and potentially weaker consumer spending.

I will mainly rely on the execution of Scenarios #1 and #2.

Buy Signal

Scenario #1: I plan to buy the pound today if the entry point at 1.3317 (green line on the chart) is reached, aiming for growth to the 1.3336 level (thicker green line on the chart). At 1.3336, I plan to exit the buy trade and open a sell trade in the opposite direction (expecting a 30–35 point correction from that level). Pound strength today depends on weak U.S. data. Important! Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy the pound in the event of two consecutive tests of the 1.3292 level while the MACD indicator is in the oversold zone. This would limit the pair's downward potential and lead to a market reversal upward. Growth to the opposite levels of 1.3317 and 1.3336 can be expected.

Sell Signal

Scenario #1: I plan to sell the pound today after the price breaks below 1.3292 (red line on the chart), leading to a rapid drop. The key target for sellers will be 1.3265, where I will exit the short position and immediately open a long trade in the opposite direction (expecting a 20–25 point rebound from the level). Sellers will act on strong data. Important! Before selling, ensure that the MACD indicator is below the zero mark and just starting to fall from it.

Scenario #2: I also plan to sell the pound today if the 1.3317 level is tested twice while the MACD is in the overbought zone. This will limit the pair's upside and trigger a reversal down toward 1.3292 and 1.3265.

What's on the chart:

Important:

Beginner Forex traders must be very cautious when making market entry decisions. It's best to stay out of the market before key economic reports to avoid sharp price swings. If you choose to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you trade large volumes and ignore money management.

And remember, successful trading requires a clear trading plan, like the one outlined above. Spontaneous trading decisions based on the current market situation are a losing strategy for intraday traders.