On Friday, the EUR/USD currency pair essentially remained flat. By the end of the day, the euro had gained around 20 pips, but overall volatility was practically zero all day. Good Friday and Easter had a noticeable impact. It's also worth noting that Donald Trump did not introduce any new tariffs or sanctions last week. As we can see on the hourly timeframe, the price has been moving sideways for over a week. So, no new tariffs – no reason to trade the pair. That's the logic most traders are following right now.

Given the clearly defined flat on the euro, trading is currently only possible from the boundaries of this range—or by waiting for it to end. However, as we've mentioned in our fundamental articles, the issue is that price can shoot in either direction at any moment, as it depends solely on Trump's actions. He could introduce new tariffs, revoke old ones—anything. Don't assume that dollar growth is now impossible. Usually, when the market believes a move is unlikely, that's exactly what ends up happening.

No trade signals were formed on Friday in the 5-minute timeframe. Only by the end of the day did the price reach the 1.1391 level, but there was no point in opening trades ahead of the weekend. Moreover, no valid signals were formed.

The latest COT report is dated April 15. The chart above clearly shows that the net position of non-commercial traders had long remained bullish. Bears barely managed to gain the upper hand but quickly lost it again. The bears' advantage has visibly diminished since Trump took office, and the dollar sharply declined. We cannot definitively say that the decline of the U.S. currency will continue, but COT reports reflect the sentiment of large players—which can change rapidly under the current circumstances.

We still see no fundamental factors justifying euro strength, but one significant factor is now driving dollar weakness. The pair may continue to correct for several more weeks or months, but a 16-year downtrend won't reverse so easily.

The red and blue lines have now crossed again, signaling a bullish trend in the market. During the latest reporting week, the "Non-commercial" group increased its long positions by 6,800 and reduced its short positions by 2,500, resulting in a net increase of 9,300 contracts.

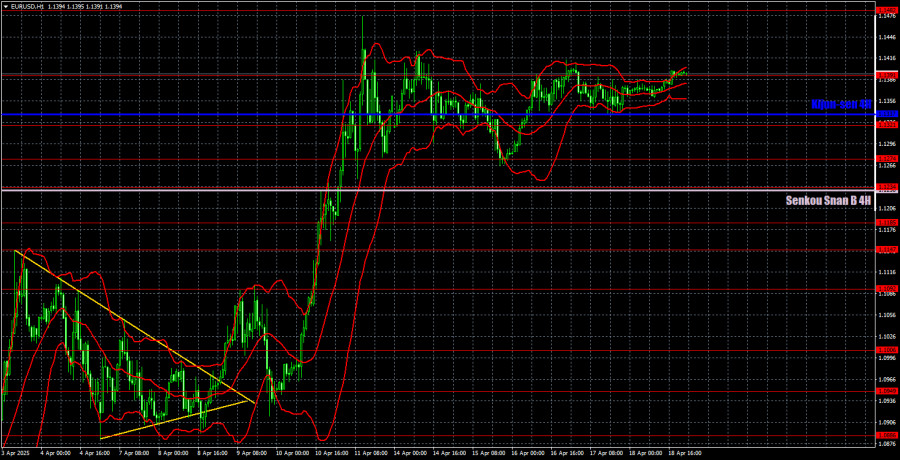

The EUR/USD pair quickly resumed its upward movement on the hourly timeframe once Trump started introducing new tariffs. The price is moving sideways, and we await Trump's subsequent actions. On the daily timeframe, the downtrend has officially been broken. This never would have happened without Trump initiating a trade war. As a result, the fundamental background has overridden the technical picture—which is rare but does happen. Unfortunately, the uptrend could end just as abruptly if Trump stops imposing tariffs and takes steps toward de-escalation.

Key levels for trading on April 21 include: 1.0757, 1.0797, 1.0823, 1.0886, 1.0949, 1.1006, 1.1092, 1.1147, 1.1185, 1.1234, 1.1274, 1.1323, 1.1391, 1.1482, as well as the Senkou Span B line (1.1230) and the Kijun-sen line (1.1337). Ichimoku indicator lines can move during the day, so keep that in mind when identifying signals. Don't forget to set your Stop Loss to breakeven once the price moves 15 pips in the right direction. This protects against losses if the signal turns out to be false.

No crucial events or reports are scheduled for Monday, neither in the European Union nor the US. However, last week demonstrated that important events do not guarantee market movements or reactions. The market lives solely on news about the trade war.