The 1.2399 price test occurred when the MACD indicator was just beginning to decline from the zero level, confirming a valid sell entry for the British pound. This resulted in a decline toward the 1.2373 target level. A buy trade on a rebound from 1.2373 allowed for an additional 15 points in profit.

Short-term optimism fueled by UK economic data should not be misleading.Global economic uncertainty and geopolitical risks, including concerns over trade tariffs, continue to weigh on investor sentiment.

Expectations of further rate cuts by the Bank of England also weaken the pound's position. Today, speeches from Catherine L. Mann (MPC member) and Andrew Bailey (BoE Governor) are scheduled. A dovish stance favoring additional rate cuts will likely trigger new short positions in GBP/USD. However, given the recent inflation data, which exceeded the BoE's target, such policy actions may seem unjustified. Policymakers have repeatedly emphasized economic recovery over inflation concerns. The market already anticipates rate cuts in the coming months, and any hints of accelerating this process from Mann and Bailey will increase pressure on the pound.

For my intraday strategy, I will focus primarily on Scenario #1 and Scenario #2.

Buy Scenarios

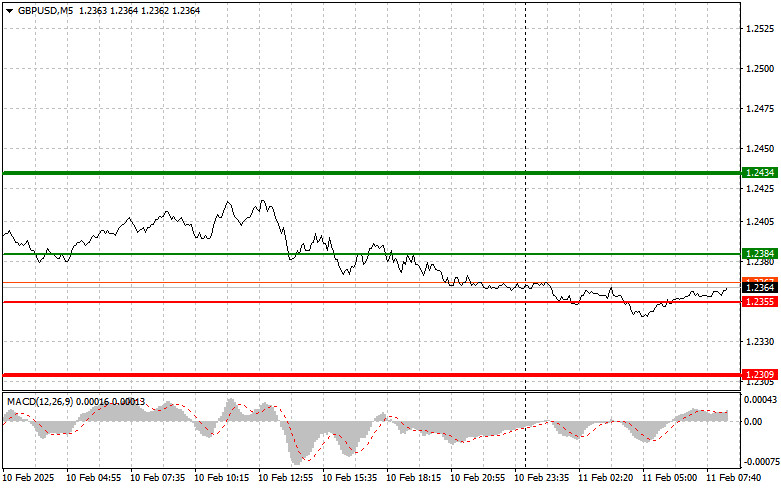

Scenario #1: Buying the pound is possible at 1.2384 (green line on the chart) with an upward target of 1.2434 (thicker green line on the chart). At 1.2434, I will exit the buy trade and open a short position, expecting a 30-35 point retracement. The GBP/USD rally would likely be a correction rather than a sustained trend.

Important! Before buying, ensure that the MACD indicator is above the zero level and just beginning to rise.

Scenario #2: Another buy opportunity arises if the price tests 1.2355 twice while the MACD indicator is in the oversold zone. This scenario limits downward potential and triggers a bullish reversal. Target levels: 1.2384 and 1.2434.

Sell Scenarios

Scenario #1: Selling the pound is planned after breaking below 1.2355 (red line on the chart), which could trigger a sharp decline. The primary bearish target is 1.2309, where I will exit the trade and initiate a buy position for a 20-25 point retracement. It's preferable to sell GBP/USD at higher levels for better risk-to-reward ratios.

Important! Before selling, ensure that the MACD indicator is below the zero level and just beginning to decline.

Scenario #2: Another sell opportunity is possible if the price tests 1.2384 twice while the MACD indicator is in the overbought zone. This scenario limits upward potential and triggers a bearish reversal.Target levels: 1.2355 and 1.2309.

Chart Breakdown

Important Notes for Beginner Forex Traders