Trade Review and Tips for Trading the Japanese Yen

The test of the 155.63 level in the first half of the day occurred when the MACD indicator had just started moving upward from the zero line, confirming a correct entry point to buy the dollar in continuation of the Asian bullish trend. However, it seems the market had its own plans, and I was eventually forced to close the trade at a loss.

Recently, Trump stated that the Fed made the right decision to pause rate cuts, which surprised market participants significantly. Nevertheless, bullish sentiment continues to dominate in the USD/JPY pair, as the Bank of Japan (BoJ) appears ready to act more aggressively. Emphasizing the importance of the Federal Reserve's decisions, Trump noted that the current economic situation demands a cautious approach. The pause in rate cuts could indicate that the Fed is evaluating inflation risks and the need to maintain stability in financial markets.

Meanwhile, the Japanese yen remains in focus. The BoJ indeed seems intent on adopting a more aggressive monetary policy, creating favorable conditions for the yen. As expectations grow regarding possible policy changes from the BoJ, currency markets are reacting to every update. If the BoJ takes steps to raise rates, it could significantly alter market dynamics.

Today, we expect U.S. ISM Manufacturing Index data for January and a speech by FOMC member Raphael Bostic. Strong data could restore demand for USD/JPY.

For intraday strategy, I will primarily rely on Scenarios #1 and #2 to continue the development of the downtrend.

Buy Signal

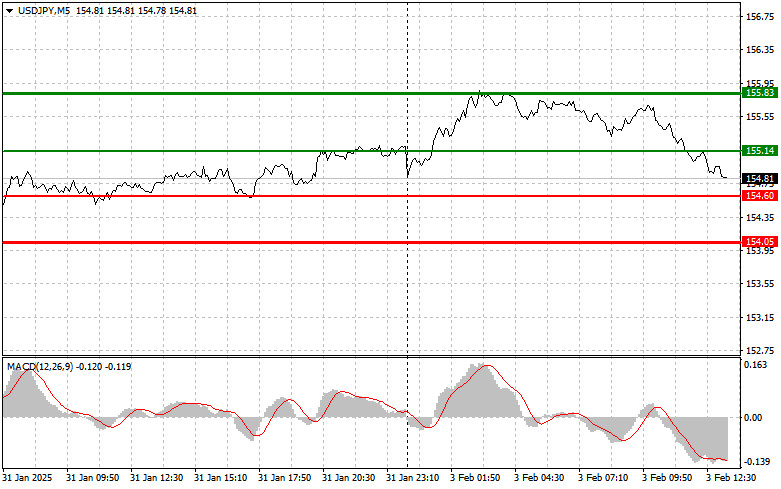

Scenario #1: I plan to buy USD/JPY today upon reaching the 155.14 entry point (green line on the chart) with a target at 155.83 (thicker green line on the chart). At 155.83, I will exit the buy position and open a sell position in the opposite direction, aiming for a 30-35 point retracement from the entry point. Buying the pair is only advisable after strong U.S. data.Important! Before buying, ensure the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy USD/JPY today if there are two consecutive tests of the 154.60 level while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and trigger a market reversal upward. Expect growth towards 155.14 and 155.83.

Scenario #1: I plan to sell USD/JPY today after it breaks below 154.60 (red line on the chart), leading to a rapid decline. The primary target for sellers will be 154.05, where I will exit the sell position and buy in the opposite direction (20-25 point rebound expected). Selling pressure on the pair today is likely only after weak U.S. data.Important! Before selling, ensure the MACD indicator is below the zero line and just starting to decline from it.

Scenario #2: I also plan to sell USD/JPY today if there are two consecutive tests of the 155.14 level while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a market reversal downward. Expect a decline towards 154.60 and 154.05.