On Friday, the GBP/USD pair also demonstrated upward movement, which should not have occurred. On Wednesday evening, the pound plummeted after the FOMC meeting results — a logical reaction. On Thursday afternoon, the pound dropped again following the Bank of England meeting — also expected. However, the pound's rally on Thursday morning and Friday is much harder to explain. Perhaps these were purely technical corrections, but in this case, the decline should resume next week, with the pound likely falling below the 1.2502 level.

On Friday, the UK released just one report — retail sales. This metric increased by 0.2% in November, which fell short of expectations. As such, this report could not have triggered the pound's rise. Similarly, the US data lacked significant resonance and, therefore, could not have caused such a sharp decline in the US dollar.

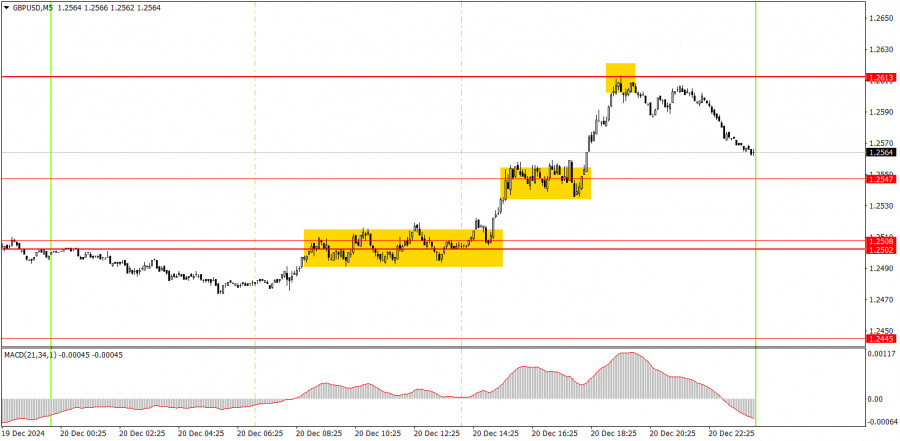

On the 5-minute timeframe, three signals were formed on Friday. The first two were particularly challenging. Initially, the price spent about five hours oscillating around the 1.2502–1.2508 area, then lingered for another couple of hours near the 1.2547 level. In both cases, buy signals were generated, and ultimately, the price reached 1.2613, where long positions could have been closed profitably. Around the 1.2613 level, a sell signal also formed, which could have brought profits to novice traders by the end of the day and week.

On the hourly timeframe, GBP/USD has completed its upward correction. We fully support the pound's decline in the medium term, as we believe this is the only logical scenario. However, it is worth remembering that the pound demonstrates high resilience against the US dollar. As a result, while a downward trend is expected, traders should rely on technical signals. The outcomes of the BoE and FOMC meetings fully support a further bearish outlook, but it's evident that the pound frequently shows unwarranted growth.

On Monday, the GBP/USD pair could resume its decline. While another corrective move is possible, a drop toward 1.2387 appears more likely.

On the 5-minute TF, you can now trade at 1.2387, 1.2445, 1.2502-1.2508, 1.2547, 1.2633, 1.2680-1.2685, 1.2723, 1.2791-1.2798, 1.2848-1.2860, 1.2913, 1.2980-1.2993. On Monday, the UK will release the third estimate of its third-quarter GDP, which does not bode well for the pound. The British economy continues to edge closer to zero growth, and that says it all.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.