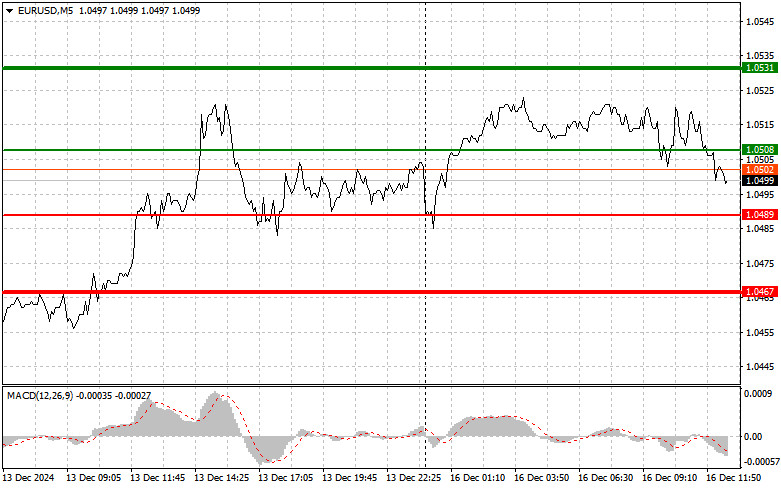

The test of the 1.0509 price level coincided with a moment when the MACD indicator had moved significantly downward from the zero line, limiting, in my opinion, the pair's bearish potential. For this reason, I did not sell the euro. No other entry points were observed.

Conflicting data from December's PMI indexes for the Eurozone prevented the pair from showing strong and decisive movement in either direction. Similar data is expected from the US in the second half of the day. Key figures on manufacturing and business activity indexes could significantly impact the currency market.

The Manufacturing PMI, which reflects the state of businesses by considering orders and production expenses, often serves as a barometer for assessing the overall economic situation. Due to several economic pressures, it is anticipated that the US manufacturing sector may post relatively weak results, which could weaken the dollar's position.

Meanwhile, the services sector, which typically constitutes the bulk of GDP, continues to demonstrate resilience and even growth. Data on the Services PMI could confirm forecasts that end-of-year sales and increased consumer spending will continue to support the economy.

The Composite PMI, combining data from both sectors, will be a key indicator. If it exceeds expectations, it could boost investor confidence and influence the Federal Reserve's monetary policy decisions.

For intraday strategies, I will rely on the implementation of Scenario #1 and Scenario #2.

Scenario #1: Today, you can buy the euro when the price reaches the level of 1.0508 (green line on the chart), aiming for growth to the level of 1.0531. At 1.0531, I plan to exit the market and sell the euro in the opposite direction, expecting a movement of 30–35 points from the entry point. A euro rise today can only be expected if US data is weak.Important! Before buying, ensure the MACD indicator is above the zero line and just beginning its upward movement.

Scenario #2: I also plan to buy the euro if there are two consecutive tests of the 1.0489 price level, at a time when the MACD indicator is in the oversold area. This will limit the pair's bearish potential and lead to a reversal upward. Growth can be expected toward the opposite levels of 1.0508 and 1.0531.

Sell Signal

Scenario #1: I plan to sell the euro after the price reaches the 1.0489 level (red line on the chart). The target will be 1.0467, where I plan to exit the market and buy immediately in the opposite direction, expecting a movement of 20–25 points back from the level. Selling pressure on the pair will return if it fails to hold near the daily high and if US statistics are strong.Important! Before selling, ensure the MACD indicator is below the zero line and just beginning its downward movement.

Scenario #2: I also plan to sell the euro if there are two consecutive tests of the 1.0508 price level, at a time when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a reversal downward. A decline can be expected toward the opposite levels of 1.0489 and 1.0467.