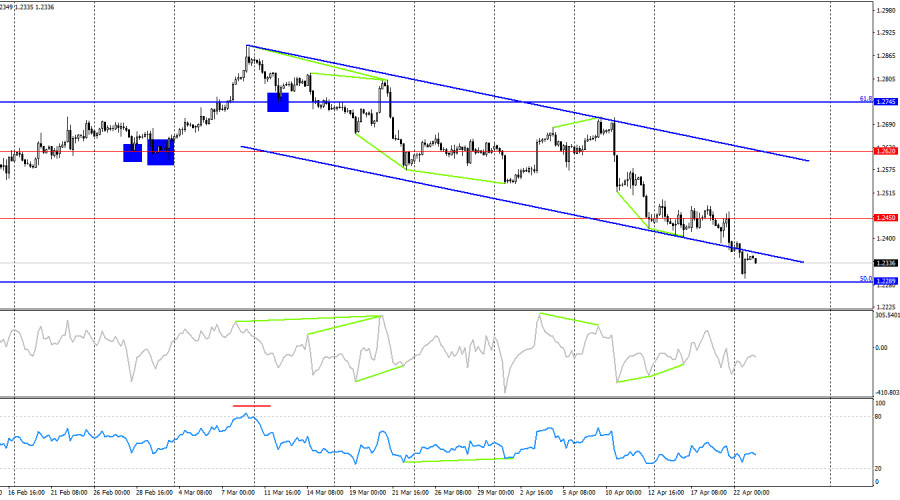

On the hourly chart, the GBP/USD pair on Monday completed a decline to the level of 1.2300, rebounded off it, and returned to the Fibonacci level of 61.8% (1.2363). The rebound of quotes from the level of 1.2363 worked in favor of the American currency and the resumption of the decline towards the level of 1.2300. Bears continue to advance on the market as they have been dormant for a long time. During this "long time," the information background repeatedly supported the dollar. However, traders only worked out some of this information. Now the British pound may continue the process of decline even without the information background.

The wave situation remains unchanged. The last completed upward wave failed to break the last peak (from March 21), and the last downward wave broke the low of the previous wave (from April 1) and is still forming. Thus, the trend for the GBP/USD pair remains "bearish," and there are no signs of its completion. The first sign of bulls transitioning to an advance could be a breakout of the peak from April 9, but bulls need to cover a distance of about 380 points to the zone of 1.2705–1.2715. It is unlikely that a trend change to "bullish" should be expected in the coming days. At the moment, even the last downward wave has not completed its formation.

On Monday, there was no information background, but today, business activity indices in the UK will be released within an hour. According to economists' estimates, the indices will stay the same in April, but there is always a chance that the forecasts need to be corrected. Considering the strength of the bears in recent weeks, I do not expect a strong rise in the British pound, even with higher business activity index values than expected by traders. Today, the pair may return to the level of 1.2300. In the future, I expect the British pound to continue to decline.

On the 4-hour chart, the pair made a reversal in favor of the American and resumed the downward process towards the corrective level of 50.0%-1.2289. The descending trend channel characterizes the current mood of traders as "bearish." A rebound of quotes from the level of 1.2289 will allow expecting some growth of the British pound towards the level of 1.2450. Consolidation of the pair's rate below the level of 1.2289 will strengthen the positions of the bears, which will target the level of 1.2035.

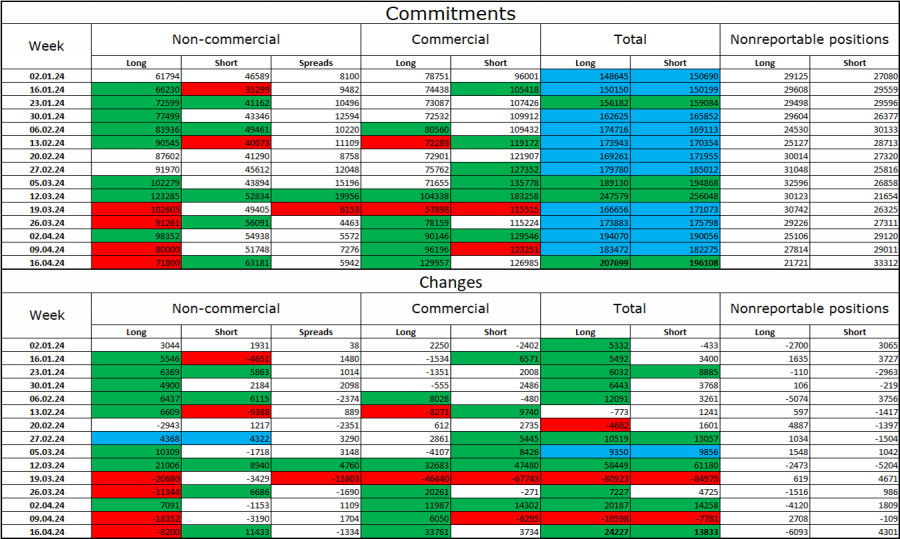

Commitments of Traders (COT) report:

The sentiment of the "non-commercial" trader category for the last reporting week has become less "bullish." The number of long contracts held by speculators decreased by 8200 units, while the number of short contracts increased by 11433 units. The overall sentiment of major players remains "bullish" but has weakened in recent weeks. The gap between the number of long and short contracts is practically absent now: 72 thousand against 63 thousand.

The prospects for a decline in the British pound are preserved. Over the last 3 months, the number of long contracts has increased from 62 thousand to 72 thousand, and the number of short contracts has increased from 47 thousand to 63 thousand. This explains the relatively weak decline of the British pound. Over time, bulls will start to get rid of buy positions or increase sell positions, as all possible factors for buying the British pound have already been worked out. Bears have demonstrated their weakness and complete unwillingness to advance over the past few months, but inflation reports in the US and the UK may give them new strength.

News calendar for the US and the UK:

UK - Services Business Activity Index (08:30 UTC).

UK - Manufacturing Business Activity Index (08:30 UTC).

US - Services Business Activity Index (13:45 UTC).

US - Manufacturing Business Activity Index (13:45 UTC).

US - New Home Sales (14:00 UTC).

On Tuesday, the economic events calendar contains several interesting entries in the US and the UK. The influence of the information background on market sentiment today may be of moderate strength.

Forecast for GBP/USD and trader recommendations:

Sales of the British pound were possible upon closing on the hourly chart below the support zone of 1.2363–1.2370, with targets at 1.2300 and 1.2238. The first target has been hit. Purchases of the pair were possible yesterday upon a rebound from the level of 1.2300 with a target of 1.2363. This target has also been hit. New purchases - upon a new rebound from the level of 1.2300 or upon closing above the resistance zone of 1.2363–1.2370.