The US labor market is cooling, and the dollar is strengthening the decline. Investors are tuning in to the dovish approach of the world's central banks until the end of this year, including the Federal Reserve. Are these premature conclusions, or did market players really feel the upcoming changes in the context of a slower rate hike?

Meanwhile, representatives of the Fed have not yet given any signs, but continue to insist that the central bank will continue to fight inflation. At the moment, there is no reason to believe that the growth of inflation, as well as rates, has reached its peak.

The new Fed representative, Philip Jefferson, noted on Tuesday that inflation is the most serious problem facing the central bank, and "it may take some time" to solve it. At the same time, the head of the San Francisco Federal Reserve, Mary Daly, continued to insist on the need to raise interest rates in the future.

Investors, apparently, ignore such statements and will be guided in their expectations based on the fundamental component, which, by the way, indicates that it's time to slow down a bit.

However, the markets can still change their minds, this happens regularly now. The key indicator of sentiment should be Friday's publication of the NFP.

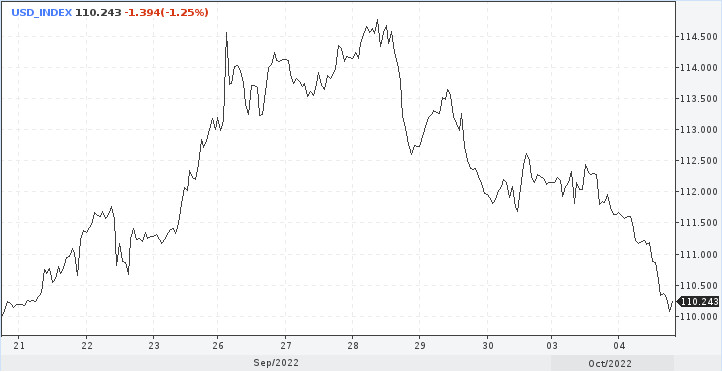

During the hours of the US session, the dollar strengthened its downward correction against the basket of competitors. Bears confidently broke through the 111.00 level.

Based on the current scenario, it seems likely that the downward dynamics will continue with a goal to weekly lows in the area of 109.35. If this level is also lost, then we should expect a retest of the intermediate support presented at the level of 108.60.

At the same time, the prospects for an upward trend will remain unchanged as long as the indicator is above the 7-month support line in the area of 107.20.

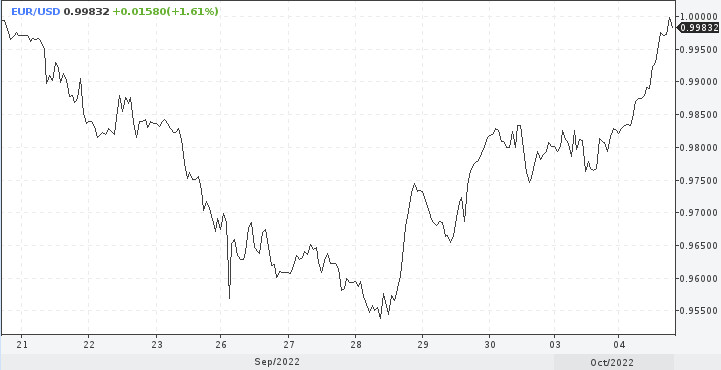

A weak dollar stimulates the recovery of the pound and the euro. The latter had a chance to take back the parity level. On Tuesday, the EUR/USD pair strengthened during the US session to 0.9977, reaching the highest level in a week. The quote has grown by more than 150 points in a day and is 440 points above last week's low.

A dangerous level on the way to further growth is the parity area and the resistance area of 1.0015. However, the 0.9900 level, according to analysts, became the initial support, followed by 0.9850.

European Central Bank President Christine Lagarde's speech was also important for the euro. However, her spatial speeches were not perceived by the market, no movements followed her rhetoric. This once again proves the great role of the dollar in the formation of EUR/USD pricing.

Lagarde, by the way, said that at the moment it is impossible to assert or assume the achievement of an inflationary peak in the region.

"The least we have to do is stop stimulating demand," she added.

The August JOLTS report revealed the largest monthly decline from 11.17 million to 10.05. The lowest figure since mid-2021. The recession was the biggest since April 2020, when the economy recovered from the first wave of the pandemic.

This may be evidence that the labor market has started to slow down. Hence this market reaction. These are not the only figures that have made investors doubt the Fed's further tough monetary plans. The negative report followed a more significant than expected decline in the September ISM manufacturing index, published on Monday. On Wednesday, the ADP report is in focus, and on Friday, the NFP.

According to the US Department of Labor, the beginning of the cooling of the market may be due to the fact that the economy is struggling with higher interest rates aimed at reducing demand and curbing inflation.

Despite the fifth month of reduction in the number of vacancies this year, their number remained above 10 million for the 14th consecutive month.

In August, there were 1.7 vacancies for every unemployed person, compared with two in July. The number of layoffs remained low, indicating a still tense labor market. This is likely to deter the Fed from aggressively tightening monetary policy in the near term, experts say.

The central bank will have the last word. Despite the pessimistic figures, the labor market looks quite healthy, which means that the current hasty conclusions of investors and other market players may once again fail. As a result, it turns out that the Fed is not ready for a pause yet.

It should be noted that the US central bank is trying to cool the demand for labor and the economy as a whole in order to reduce inflation to the target level of 2%. Since March, it has raised its rate from almost zero to the current range from 3.00% to 3.25%, and last month it became known that a more significant increase is expected this year.