US stock indices closed modestly higher on Tuesday. The S&P 500 rose 0.26%, the Nasdaq 100 added 0.26% and the Dow Jones Industrial Average jumped 0.60%.

The US equity rally received fresh momentum as fears of an overheating technology sector eased after impressive results from a leading chipmaker. Asian indices also gained about 0.3% and pushed to record highs after Taiwan Semiconductor Manufacturing Co.'s earnings report revived investor bets on artificial intelligence. Ten?year Treasury yields showed minimal movement for a fifth consecutive week.

Elsewhere, the yen strengthened 0.1% against the dollar after Japan's finance minister voiced concern about the currency's weakness. Oil posted its largest decline since June. Gold and silver also fell.

US stocks advanced amid growing confidence in the resilience of the technology sector — a key market growth driver — following recent worries about rich valuations and heavy capital spending. DSG Global said that in recent weeks technology stocks had appeared vulnerable as investors rotated away from mega?cap names into more cyclical areas.

Traders continued to monitor rising tensions in the Middle East after Fox News reported that at least one US aircraft carrier is heading to the region. According to the report, US forces are preparing a range of options depending on developments in Iran over the coming days.

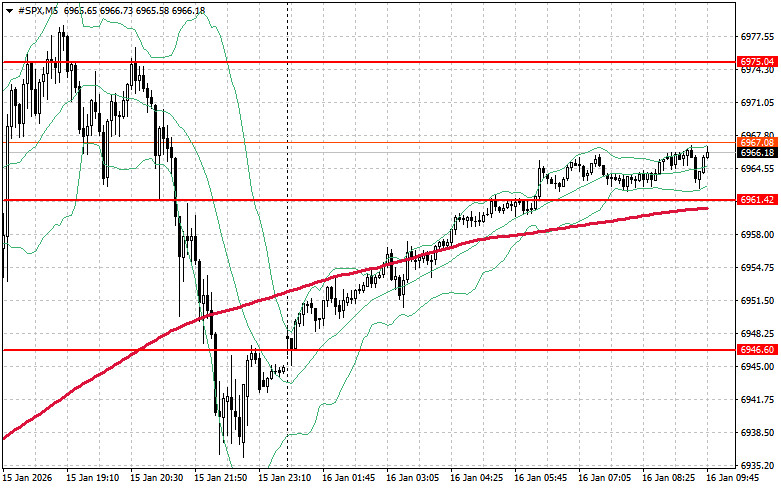

As for a technical outlook for the S&P 500, the primary task for buyers today is to overcome the nearest resistance at $6,975. Clearing that level would signal upside and open the path to $6,993. Equally important for bulls is maintaining control above $7,013, which would further strengthen buyer positions. If risk appetite weakens and the market moves lower, buyers must show strength near $6,961. A break below that level would quickly push the index back to $6,946 and open the way to $6,930.

TAUTAN CEPAT