Trade Analysis and Tips for Trading the European Currency

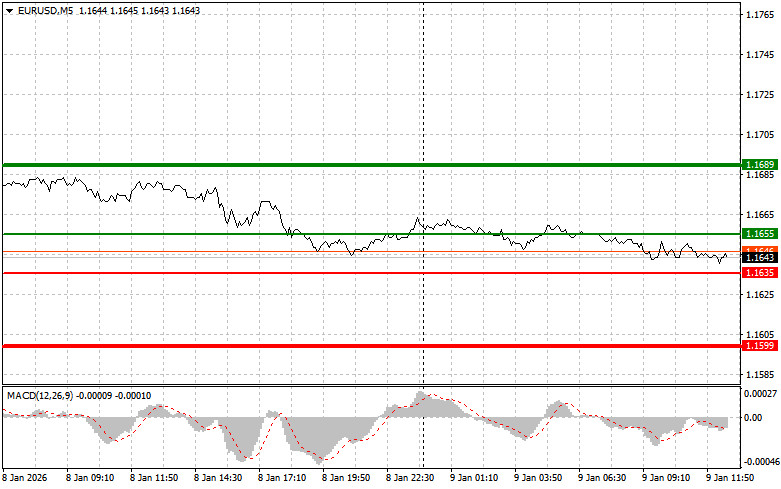

The test of the 1.1642 price level occurred at a moment when the MACD indicator had moved significantly below the zero line, which limited the pair's further downward potential. For this reason, I did not sell the euro.

Positive data on retail sales dynamics in the eurozone suggested that a major decline in the pair during the first half of the day was unlikely. However, the euro's upward movement was also restrained by concerns about the future development of the European economy. Market participants remain focused on the energy and geopolitical situation in Europe. In addition, the European Central Bank does not intend to continue cutting interest rates, which forces consumers to be more cautious with their spending.

The upcoming release of macroeconomic statistics from the United States is expected to trigger significant volatility in financial markets. All market participants will closely follow the publication of data on nonfarm payroll employment, the unemployment rate, and changes in average wages. Particular importance will be given to the relationship between these indicators. For example, a strong increase in employment combined with rising wages could boost consumer optimism and contribute to higher inflation. In such a scenario, the Federal Reserve is likely to continue its policy of keeping interest rates unchanged, which could lead to a strengthening of the U.S. dollar. At the same time, weak labor market data, combined with declining consumer confidence and lower inflation expectations, could force the Fed to take a more dovish stance. This, in turn, could lead to a weakening of the U.S. currency.

As for the intraday strategy, I will rely more on the implementation of scenarios No. 1 and No. 2.

Buy Signal

Scenario No. 1: Today, buying the euro is possible when the price reaches the 1.1655 level (green line on the chart), with a target of growth toward the 1.1689 level. At 1.1689, I plan to exit the market and also sell the euro in the opposite direction, aiming for a move of 30–35 points from the entry point. Strong euro growth can only be expected after weak U.S. data.Important! Before buying, make sure that the MACD indicator is above the zero line and is just beginning to rise from it.

Scenario No. 2: I also plan to buy the euro today in the case of two consecutive tests of the 1.1635 price level when the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to a reversal of the market upward. Growth toward the opposite levels of 1.1655 and 1.1689 can be expected.

Sell Signal

Scenario No. 1: I plan to sell the euro after the price reaches the 1.1635 level (red line on the chart). The target will be the 1.1599 level, where I intend to exit the market and immediately buy in the opposite direction (aiming for a 20–25 point move in the opposite direction from the level). Pressure on the pair will return if strong labor market data is released.Important! Before selling, make sure that the MACD indicator is below the zero line and is just beginning to decline from it.

Scenario No. 2: I also plan to sell the euro today in the case of two consecutive tests of the 1.1655 price level when the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a reversal of the market downward. A decline toward the opposite levels of 1.1635 and 1.1599 can be expected.

What's on the Chart:

Important. Beginner Forex traders should make entry decisions very cautiously. Ahead of major fundamental reports, it is best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always place stop-loss orders to minimize losses. Without stop-loss orders, you can very quickly lose your entire deposit—especially if you do not use money management and trade large volumes.

And remember, successful trading requires a clear trading plan, such as the one presented above. Spontaneous trading decisions based on the current market situation are an inherently losing strategy for an intraday trader.

TAUTAN CEPAT