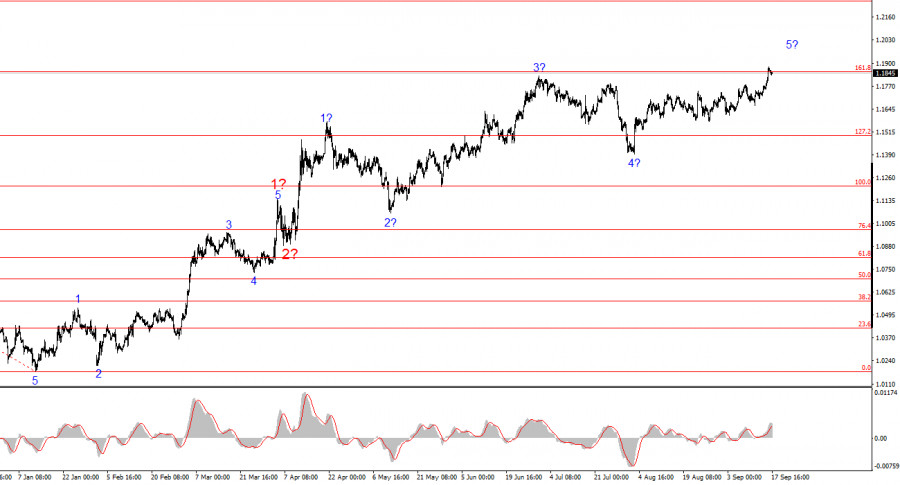

The wave pattern on the 4-hour chart for EUR/USD has not changed for several months, which is very encouraging. Even when corrective waves are formed, the overall structure remains intact. This allows for accurate forecasts. Let me remind you that wave patterns do not always look like textbook examples. At present, the structure looks very good.

The upward trend section continues to develop, and the news background mostly works against the dollar. The trade war initiated by Donald Trump is ongoing. The confrontation with the Fed is ongoing. Market "dovish" expectations for the Fed rate are growing. The market has a very low assessment of Trump's first 6–7 months in office, even though GDP growth in Q2 reached 3%.

At the moment, it can be assumed that the formation of impulse wave 5 continues, with targets possibly extending up to the 1.25 level. Within this wave, the structure is rather complex due to the sideways movement observed over the past month. However, waves 1 and 2 can still be distinguished. Thus, I believe the instrument is now in wave 3 of 5.

The EUR/USD pair declined slightly on Wednesday, but the main events are scheduled for this evening. Few doubt that within a few hours price swings will become much wider, but I will not predict in which direction. The outcome of the Fed meeting can be predicted with relative ease. Most FOMC members will vote for a rate cut, not because Trump wants it, but because Trump has done everything to slow the U.S. economy and "cool" the labor market. Now the regulator must solve the problems created by the president. Based on this, a rate cut today is already predetermined and will likely be approved unanimously by the FOMC.

What will happen next (before the end of the year)? I believe we will not get an answer today. Let me remind you that Jerome Powell does not like to make strong statements or promises. What are some market participants hoping for now? That Powell will openly promise to cut rates several more times? I think such a scenario is impossible by definition. At best, the Fed Chair will outline a priority for the regulator until the end of the year. This could be either "focus only on the labor market" or "balance between the labor market and inflation." I lean toward the second scenario. If this is the case, the Fed may carry out two, or at most three, rounds of easing—not by the end of the year, but overall. To see stronger easing, Trump would need to replace much of the FOMC membership.

Based on the EUR/USD analysis, I conclude that the instrument continues to form an upward trend section. The wave pattern still fully depends on the news background related to Trump's decisions, and the domestic and foreign policies of the new White House administration. The targets of the current trend section may extend up to the 1.25 level. The news background remains unchanged, therefore I remain in long positions despite reaching the first target near 1.1875, which corresponds to the 161.8% Fibonacci level. By the end of the year, I expect the euro to rise to 1.2245, which corresponds to the 200.0% Fibonacci level.

On a smaller scale, the entire upward section of the trend is visible. The wave pattern is not the most standard, as the corrective waves vary in size. For example, the larger wave 2 is smaller than the internal wave 2 in 3. However, such cases also occur. Let me remind you that it is better to highlight clear structures on the chart, rather than try to fit every wave. The upward structure currently raises almost no questions.

Main principles of my analysis:

TAUTAN CEPAT