The test of the 1.3421 level occurred when the MACD indicator had already moved significantly below zero, which limited the pair's downside potential. For this reason, I did not sell the pound.

In the first half of the day, investors' attention will shift to the UK retail sales release. This indicator, which reflects consumer spending trends, serves as an important barometer of the British economy's health. Moderate growth in retail sales is forecast, which may actually have a negative effect on GBP buyers. At the same time, the Halifax House Price Index—one of the UK's leading mortgage lenders—will also be released. This index is considered one of the most reliable indicators of the real estate market. Prices are expected to continue rising, though at a much more modest pace.

As I noted above, strong retail sales and housing price data can support the pound and boost investor confidence in the UK's economic outlook. Conversely, disappointing numbers may pressure GBP and provoke concerns about slowing growth.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

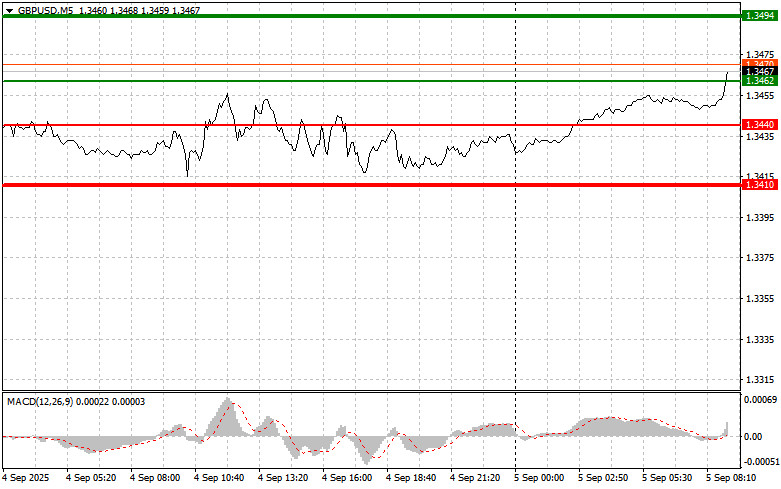

Scenario #1: Today, I plan to buy the pound when the entry point near 1.3462 (green line on the chart) is reached, targeting a rise toward 1.3494 (thicker green line on the chart). Around 1.3494, I plan to exit longs and open short positions in the opposite direction (expecting a 30–35 pip move back from this level). GBP upside should only be expected after very strong data. Important! Before buying, ensure the MACD indicator is above zero and beginning to rise.

Scenario #2: I also plan to buy the pound today after two consecutive tests of the 1.3440 level while MACD is in the oversold area. This will limit the pair's downside potential and likely trigger an upward reversal. A move to the opposite levels of 1.3462 and 1.3494 can be expected.

Scenario #1: I plan to sell the pound today after the 1.3440 level (red line on the chart) is broken, which should lead to a rapid decline. The main target will be 1.3410, where I plan to exit shorts and immediately open long positions (aiming for a 20–25 pip move in the opposite direction from this level). Pound sellers may only return after very weak data. Important! Before selling, ensure the MACD is below zero and starting to decline.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of the 1.3462 level when the MACD indicator is in the overbought area. This will limit the pair's upside potential and result in a downward reversal. A move down to the opposite levels of 1.3440 and 1.3410 can be expected.

Thin green line – entry price at which the instrument can be bought.

Thick green line – suggested price for taking profit or manually securing profits, as further growth above this level is unlikely.

Thin red line – entry price at which the instrument can be sold.

Thick red line – suggested price for taking profit or manually securing profits, as further decline below this level is unlikely.

MACD indicator: When entering the market, it is important to refer to overbought and oversold areas.

Important. Beginner forex traders should exercise extreme caution when making entry decisions. Before important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during the release of news, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes. And remember: for successful trading, you need a clear trading plan, as I described above. Making spontaneous trading decisions based on the current market situation from moment to moment is a losing strategy for an intraday trader.

TAUTAN CEPAT