The British pound, as has become common practice, was traded today using the Mean Reversion strategy. However, for other trading instruments, including the yen, I did not see anything of interest. As a result, I did not trade using Momentum.

A sharp contraction in the eurozone trade balance led to a decline in the euro. The widening trade deficit, driven by U.S. tariffs and weakening global demand, placed significant pressure on the single European currency. Investors, concerned about the deteriorating economic outlook for the region and the growing risk of recession, began actively offloading euro-denominated assets. Under these conditions, the European Central Bank will also have to take this into account. In the long term, restoring the competitiveness of the European economy and offsetting the damage from tariffs could help the euro strengthen. However, in the short term, the outlook for the single currency remains uncertain and depends on many factors, including global economic trends.

In the second half of the day, U.S. housing market data from the NAHB index will be released. This indicator, reflecting homebuilders' confidence in the prospects for new home sales, is an important barometer of the U.S. housing market's health. Analyst expectations vary, but most forecast a slight increase in the index. If expectations are not met, it could serve as another sign of slowing activity in the sector, driven by rising mortgage interest rates and overall economic uncertainty.

In the case of strong data, I will rely on implementing the Momentum strategy. If the market shows no reaction to the release, I will continue using the Mean Reversion strategy.

Momentum Strategy (breakout) for the second half of the day:

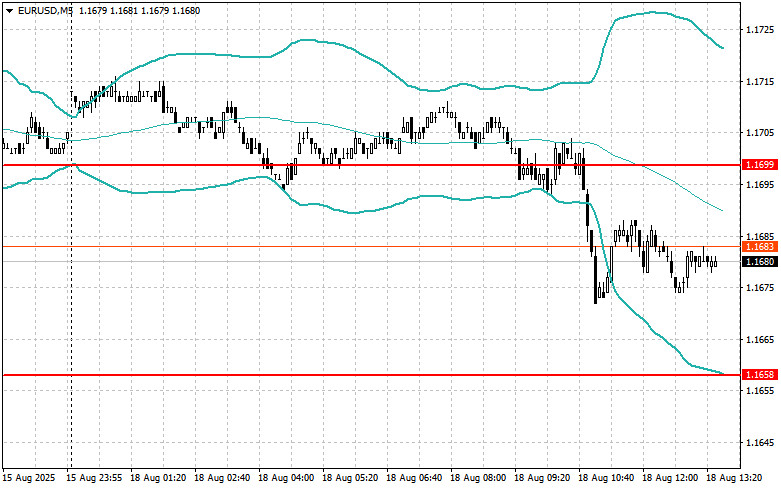

For EUR/USD

Selling on a breakout of 1.1666 may lead to a decline toward 1.1635 and 1.1601.

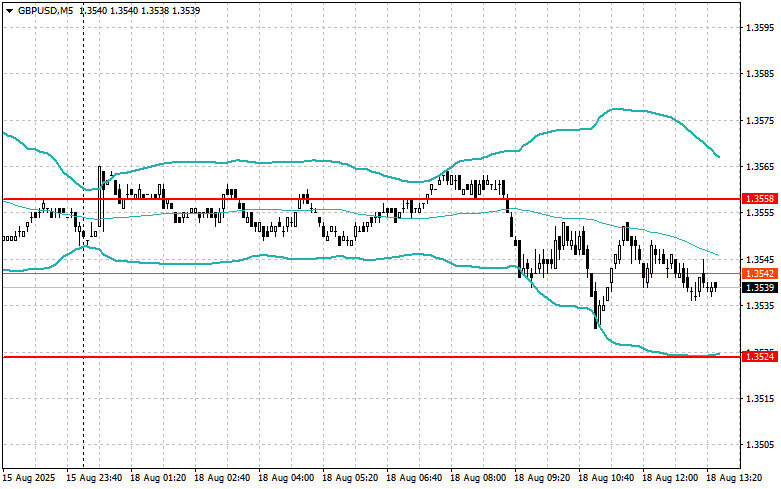

For GBP/USD

For USD/JPY

Mean Reversion Strategy (pullback) for the second half of the day:

For EUR/USD

For GBP/USD

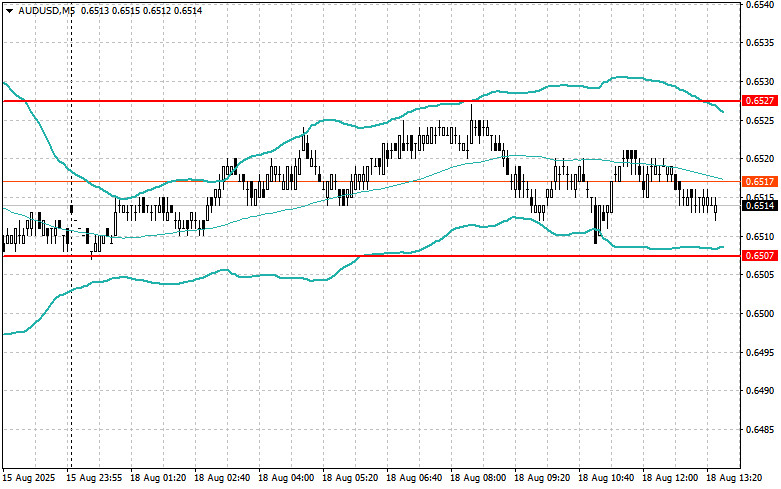

For AUD/USD

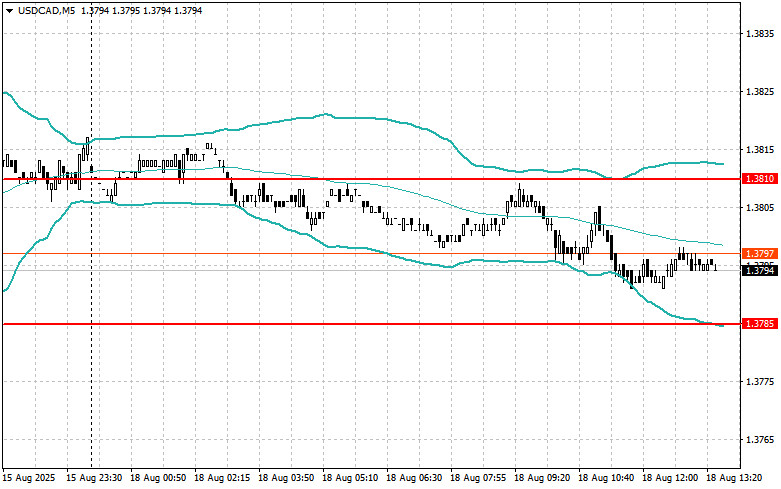

For USD/CAD

TAUTAN CEPAT