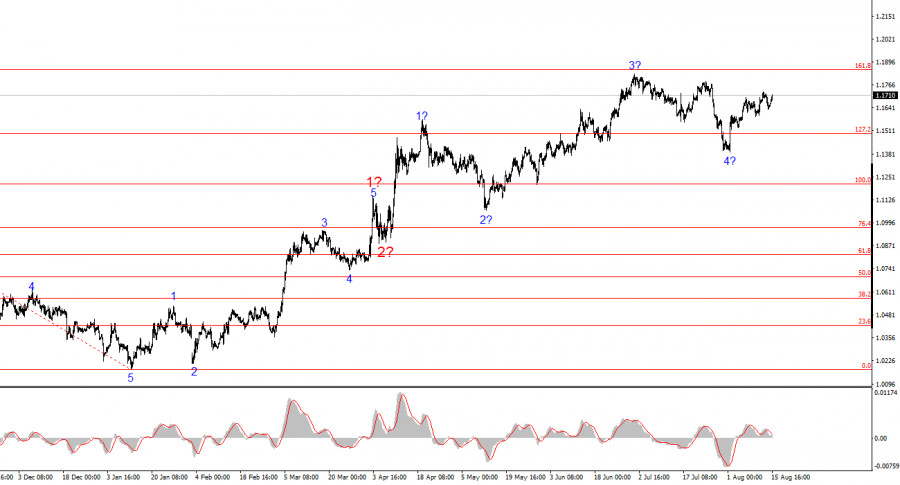

The wave pattern on the 4-hour chart for EUR/USD has remained unchanged for several months, which is a positive sign. Even when corrective waves form, the overall structure remains intact, allowing for accurate forecasts. It is worth noting that wave structures do not always resemble textbook examples.

The formation of an upward trend segment is ongoing, with the news backdrop largely favoring the euro rather than the dollar. The trade war initiated by Donald Trump continues, as does the confrontation with the Federal Reserve. Dovish expectations are growing. Trump's "One Big Law" will increase U.S. government debt by 3 trillion dollars, while the president continues to raise and impose new tariffs. The market has a generally low opinion of Trump's first six months in office, despite 3% economic growth in the second quarter.

At this stage, it can be assumed that wave 4 has been completed. If so, the formation of impulsive wave 5 has begun, with potential targets extending up to the 1.25 level. While wave 4 could still develop into a more extended five-wave corrective structure, the current assumption is based on the most probable scenario.

The EUR/USD rate rose by 70 basis points during the day, with demand for the euro increasing from the start of the trading session, even overnight. This raises the question of why, given that on Thursday the U.S. dollar was in high demand. On that day, four significant reports were released in Europe and the U.S., but only the U.S. Producer Price Index (PPI) made a notable impact. The monthly PPI rose by 0.9%, compared with a typical 0.2–0.3%. Markets quickly concluded that the Fed's dovish stance might weaken — if inflation is rising, aggressive monetary policy easing becomes less likely. However, as noted yesterday, the dollar's gains were only a corrective wave within the upward trend. While the PPI report slightly lowered the probability of policy easing, it did not affect expectations for September specifically, but rather for easing in general.

In other words, after the PPI release, markets now expect stronger inflation growth than in recent months. If inflation rises faster, the Fed — while aiming to support the labor market — may still cut rates more slowly than previously expected. Before Thursday, markets allowed for up to three rounds of easing in 2025 or a 50-basis-point cut in September. Now, expectations are generally in line with the two rounds mentioned by Fed officials since the start of the year.

Based on the above and the current wave pattern, the dollar had little chance of reversing the upward trend or initiating the fifth wave within the corrective structure of the larger wave 4.

Based on the EUR/USD analysis, the pair continues to build an upward trend segment. The wave pattern still largely depends on the news backdrop linked to Trump's decisions and U.S. foreign policy. Targets for this trend segment may extend to the 1.25 area. Accordingly, I continue to consider long positions with targets near 1.1875, corresponding to the 161.8% Fibonacci level, and higher. I assume wave 4 is complete, making this a favorable time for buying.

Key principles of my analysis:

TAUTAN CEPAT