Trade Analysis and Recommendations for the Japanese Yen

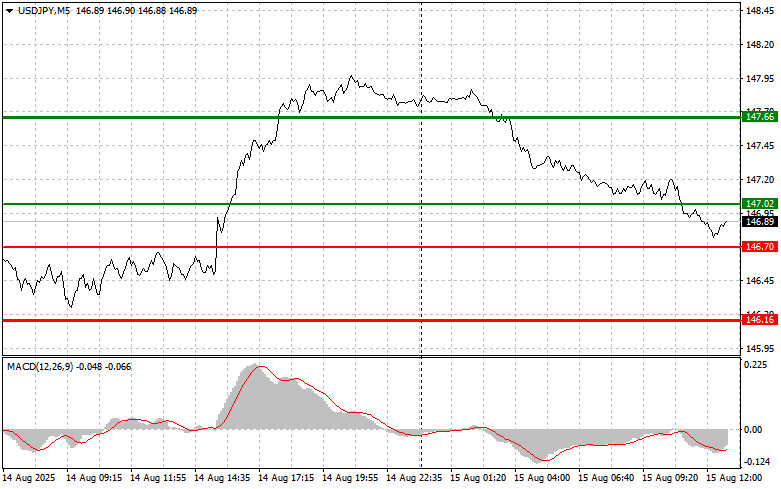

The test of 147.05 occurred when the MACD indicator had just begun moving down from the zero line, confirming a correct entry point for selling the dollar. As a result, the pair fell by almost 30 points.

Demand for the yen persisted after a strong report released earlier in the day on Japan's GDP growth. However, this may change during the U.S. session. Market participants are focused on retail sales and industrial production data, due in the second half of the day. Retail sales dynamics are traditionally considered an important indicator of consumer spending, which plays a significant role in U.S. GDP formation. A notable rise in retail sales may signal persistent inflationary pressure and prompt the Federal Reserve to adopt a cautious stance on interest rates, leading to a stronger U.S. dollar—especially in light of yesterday's inflation figures. Conversely, slower retail sales growth could indicate weakening economic activity and the need for monetary policy easing.

Equally important is the industrial production report, which will help assess conditions in the manufacturing sector. Also in focus will be the University of Michigan Consumer Sentiment Index and inflation expectations, which reflect public confidence in the economy and forecasts for future inflation. Changes in these indicators could influence consumer behavior, investment decisions, and the Fed's policy strategy.

For intraday strategy, I will focus mainly on implementing Scenarios No. 1 and No. 2.

Buy Signal

Scenario No. 1: I plan to buy USD/JPY today at the entry point around 147.02 (green line on the chart) with a target of rising to 147.66 (thicker green line on the chart). Around 147.66, I will exit buy positions and open sell in the opposite direction, aiming for a 30–35-point move in the reverse direction from that level. A strong rise in the pair can be expected after robust U.S. data. Important: Before buying, make sure the MACD indicator is above the zero line and only starting to rise from it.

Scenario No. 2: I also plan to buy USD/JPY today if there are two consecutive tests of 146.70 when the MACD indicator is in the oversold zone. This will limit the pair's downward potential and trigger a reversal upward. Growth toward the opposite levels of 147.02 and 147.66 can be expected.

Sell Signal

Scenario No. 1: I plan to sell USD/JPY today after it breaks below 146.70 (red line on the chart), which should lead to a quick decline in the pair. The key target for sellers will be 146.16, where I will exit sell positions and immediately open buys in the opposite direction, aiming for a 20–25-point move in the reverse direction from that level. Downward pressure on the pair will persist only if U.S. statistics are weak. Important: Before selling, make sure the MACD indicator is below the zero line and only starting to decline from it.

Scenario No. 2: I also plan to sell USD/JPY today in the event of two consecutive tests of 147.02 when the MACD indicator is in the overbought zone. This will limit the pair's upward potential and trigger a reversal downward. A decline toward the opposite levels of 146.70 and 146.16 can be expected.

Chart Key:

Important: Beginner Forex traders should be extremely cautious when making entry decisions. Before the release of key fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-loss orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

Remember that successful trading requires a clear trading plan, like the one presented above. Making spontaneous trading decisions based on the current market situation is initially a losing strategy for an intraday trader.

TAUTAN CEPAT