The European Union has ultimately made a move toward Donald Trump. However, calling it a compromise would be inaccurate, as it is Brussels—not Washington—that is largely conceding. Nevertheless, media reports indicate that the new round of negotiations has brought the parties closer to signing an agreement. What kind of agreement could this be?

As usual, the markets have not been given the full details. Negotiators have only revealed that a single tariff rate of 15% may apply to all imports from the European Union, excluding sector-specific duties. It is worth recalling that Donald Trump did not limit himself to tariffs against individual countries. He also imposed duties on entire sectors and groups of goods. For instance, the US imposes a 50% tariff on steel and aluminum imports from any country and a 25% tariff on automobiles. Starting August 1, Trump wants to introduce tariffs on copper (50%) and pharmaceuticals (200%). In my view, this list will not stop there—Trump has already announced plans to impose individual tariffs on all countries worldwide.

Even the potential deal with the EU (which has not yet been signed or agreed upon) cannot be seen as a de-escalation of the global trade war. Trump intends to continue pressuring all countries, meaning that total and average U.S. import duties will likely keep rising. Meanwhile, the EU is seeking a uniform tariff for all of its exports to the US, aiming to reduce duties on steel, copper, aluminum, automobiles, and pharmaceuticals. The remaining terms of the agreement are minor details, and it is still unclear whether Trump will agree to any concessions.

It is also important to note that if the parties fail to sign the agreement by August 1, all imports from the European Union will be subject to a 30% tariff. In response, Brussels is prepared to impose equivalent tariffs on goods worth over 100 billion dollars. I believe that an agreement is possible, but only if Brussels continues to allow itself to be pressured. The latest reports suggest this is precisely what is happening.

It is also worth noting that neither the trade deal with Japan nor the progress in US–EU negotiations has had a positive effect on the U.S. dollar exchange rate. The market remains highly skeptical of Donald Trump's trade policy.

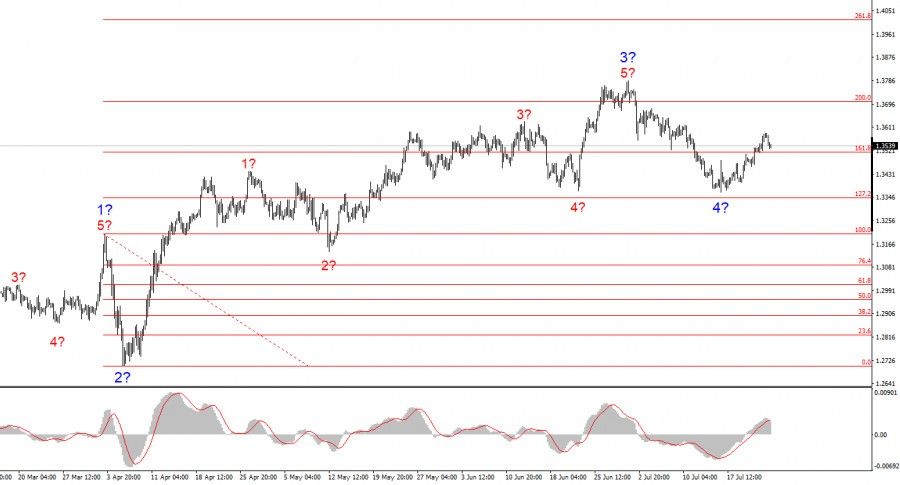

EUR/USD Wave Picture:Based on the analysis of EUR/USD, I conclude that the instrument continues to form an upward trend segment. The wave pattern remains entirely dependent on the news background related to Trump's decisions and US foreign policy, with no positive developments so far. The trend targets may extend up to the 1.25 level. Therefore, I continue to consider long positions with targets around 1.1875, which corresponds to 161.8% Fibonacci, and higher. The unsuccessful attempt to break through 1.1572, which corresponds to 100.0% Fibonacci, indicates the market's readiness for further purchases. The anticipated wave 4 may take a three-wave form.

The wave pattern for GBP/USD remains unchanged. We are observing the formation of an upward, impulsive trend segment. Under Donald Trump, markets may face numerous shocks and reversals that could significantly impact the wave picture, but for now, the working scenario remains intact. The targets of the upward trend are now located near 1.4017, which corresponds to 261.8% Fibonacci of the presumed global wave 2. A corrective wave sequence within wave 4 is currently unfolding. Traditionally, this should consist of three waves, though the market may limit it to one.

Key Principles of My Analysis:

TAUTAN CEPAT