Prezidentka Federální rezervní banky v San Francisku Mary Dalyová v úterý doporučila, aby centrální banka přistupovala k úpravě úrokových sazeb opatrně vzhledem k silné ekonomice a nejistotě spojené s novou politikou Trumpovy administrativy.

Dalyová se ve svém projevu na Brigham Young University v Provo ve státě Utah vyjádřila, že dobré zdraví ekonomiky a současná stabilita politiky poskytly centrální bance příležitost postupovat pomalu a opatrně.

Daly uvedl, že tvrdá ekonomická data ukazují, že růst a trh práce zůstávají silné. Vyjádřila však mírné obavy z možného dočasného zvýšení inflace v důsledku cel. Tento bod blíže nerozvedla.

Analisis Trading dan Tips untuk Trading Euro

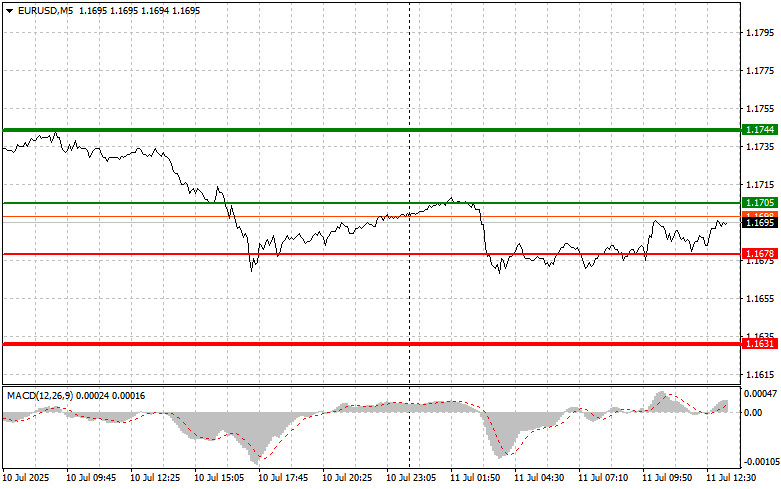

Pengujian harga di 1.1694 terjadi ketika indikator MACD sudah naik secara signifikan di atas garis nol, membatasi potensi kenaikan pasangan ini.

Mengingat tidak adanya reaksi pasar yang diharapkan terhadap data Indeks Harga Konsumen Italia dan Indeks Harga Produsen Jerman, fluktuasi EUR/USD tetap relatif tenang. Oleh karena itu, saya tidak menganggap pengujian di 1.1694 sebagai sinyal kuat untuk membeli euro. Sangat mungkin bahwa pasar sedang memposisikan diri untuk peristiwa yang lebih berarti, seperti pertemuan Bank Sentral Eropa dan Federal Reserve yang akan datang. Namun, kita tidak mungkin melihat pergerakan yang kuat dan terarah hingga akhir minggu ini.

Pada sore hari, tanpa adanya pernyataan baru dari Donald Trump, aktivitas pasar diperkirakan akan tetap rendah. Rilis pernyataan anggaran bulanan AS tidak mungkin mempengaruhi trading mata uang, dan tidak ada data ekonomi penting lainnya yang dijadwalkan. Kurangnya publikasi signifikan, ditambah dengan ketidakpastian geopolitik yang sedang berlangsung, dapat memicu volatilitas jangka pendek, tetapi pergerakan yang berkelanjutan tidak mungkin terjadi.

Untuk strategi intraday, saya akan mengandalkan terutama pada pelaksanaan Skenario #1 dan #2.

Sinyal Beli

Skenario #1: Saya berencana membeli EUR/USD hari ini setelah harga mencapai level 1.1705 (garis hijau pada grafik), dengan target kenaikan menuju 1.1744. Di sekitar 1.1744, saya berniat untuk keluar dari posisi beli dan membuka posisi jual, mengantisipasi pergerakan 30–35 poin ke arah sebaliknya. Kenaikan kuat pada euro tidak mungkin terjadi hari ini. Penting: Sebelum membeli, pastikan indikator MACD berada di atas garis nol dan baru mulai naik dari situ.

Skenario #2: Saya juga berencana membeli EUR/USD hari ini jika ada dua kali pengujian berturut-turut pada level 1.1678 sementara indikator MACD berada di wilayah oversold. Ini seharusnya membatasi potensi penurunan pasangan ini dan mengarah pada pembalikan ke atas. Target yang diharapkan adalah 1.1705 dan 1.1744.

Sinyal Jual

Skenario #1: Saya berencana menjual EUR/USD setelah harga mencapai 1.1678 (garis merah pada grafik), dengan target 1.1631. Pada 1.1631, saya berencana keluar dari posisi jual dan membuka posisi beli, dengan tujuan retracement 20–25 poin ke arah sebaliknya. Tekanan jual kemungkinan akan kembali hanya setelah ada komentar baru dari Trump. Penting: Sebelum menjual, pastikan indikator MACD berada di bawah garis nol dan baru mulai bergerak ke bawah.

Skenario #2: Saya juga berencana menjual EUR/USD hari ini jika ada dua kali pengujian berturut-turut pada 1.1705 sementara indikator MACD berada di wilayah overbought. Ini akan membatasi potensi kenaikan pasangan ini dan memicu pembalikan ke bawah. Target yang diharapkan adalah 1.1678 dan 1.1631.

Sebaiknya, para trader pemula di pasar forex perlu berhati-hati dalam mengambil keputusan untuk memasuki pasar. Lebih baik untuk tidak terlibat dalam pasar menjelang rilis laporan fundamental penting agar terhindar dari fluktuasi harga yang tidak stabil. Apabila Anda memutuskan untuk trading ketika ada rilis berita, sangat disarankan untuk selalu menetapkan stop-loss order demi meminimalkan kerugian. Kegagalan dalam melakukannya berpotensi menyebabkan Anda kehilangan deposit secara keseluruhan, terutama apabila bertransaksi dalam jumlah besar tanpa mengatur manajemen keuangan secara baik.Ingatlah, untuk meraih kesuksesan dalam trading, diperlukan sebuah rencana trading yang terperinci, sebagaimana telah dijelaskan sebelumnya. Mengambil keputusan trading tanpa persiapan terlebih dahulu berdasarkan kondisi pasar yang sedang berlangsung bisa menjadi strategi yang berisiko bagi para trader intraday.

TAUTAN CEPAT