He meant well, but it turned out the usual way. Donald Trump firmly believes that tariffs can replace income tax, generate massive revenue for the budget, and bring about a new golden age. However, even American companies that manufacture and sell goods within the U.S. risk taking a hit. Packaging may come from China, and finding new suppliers takes time. As a result, EUR/USD bears remain under pressure despite attempts to counterattack.

Trump still has a soft spot for U.S. stocks. Their recent decline followed the hawkish rhetoric of Jerome Powell. The Federal Reserve Chair blamed the White House's largest tariff hikes since the 1930s for potentially accelerating inflation and worsening labor market conditions. In response, Trump called him someone who makes responsible decisions too late and demanded an immediate rate cut.

Rumors are circulating in the media that Jerome Powell might be next if the White House has already managed to remove senior officials. Could Trump pull off the impossible? That would be bad news for markets and the dollar. U.S. assets are already suffering from a loss of investor confidence. This trend could worsen if the market begins to doubt the independence of the Fed.

The U.S. President can only envy the European Central Bank, which just cut the deposit rate for the seventh time during the current monetary easing cycle—from 2.5% to 2.25%. Interestingly, the accompanying statement no longer included the phrase "policy remains restrictive." Could this mean that Governing Council members believe the easing cycle is coming to an end? If so, it might lend some support to EUR/USD.

In practice, halting monetary expansion could deprive European equities of key support. Capital may no longer flow from North America to Europe as quickly, and EUR/USD bears could launch another counterattack. The music may not play much longer on their street: the risk of the U.S. dollar falling into negative territory suggests that the dollar's best days could be behind it.

Only Trump might be able to save it. But the Republican cannot abandon the tariff policy now—he's gone too far. There's no turning back. The only hope lies in progress in trade negotiations between the U.S. and other countries, especially Japan. If Tokyo can't reach an agreement with Washington, no one will.

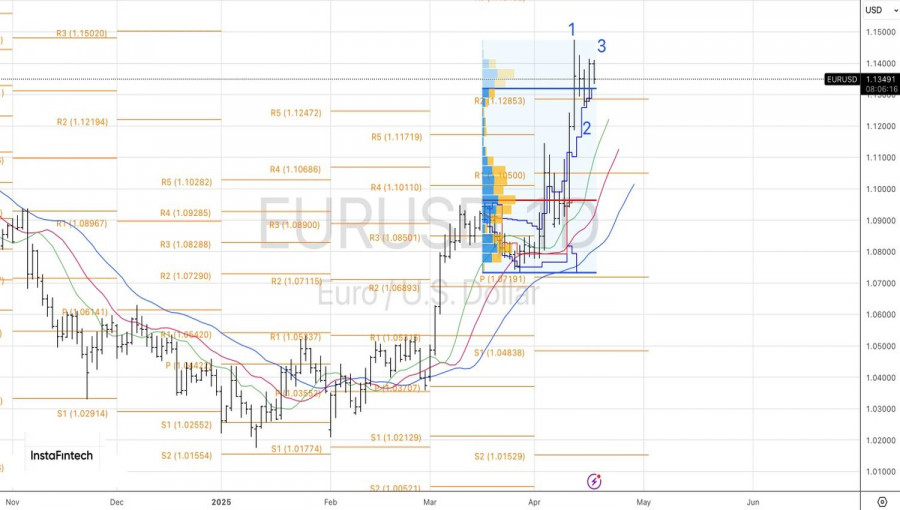

Technically, on the daily EUR/USD chart, a 1-2-3 reversal pattern may be forming. However, to activate it, the price must fall below the local low at point 2, corresponding to the 1.129 level. If that happens, the chances of a pullback will increase; if not, it's best to stick with the current buying strategy.

TAUTAN CEPAT