I přes nedávný pokles jsou čínské akcie připraveny dosáhnout nejlepšího výkonu během Národního lidového kongresu od roku 2018.

Index MSCI China sice v úterý klesl spolu s asijskými akciemi kvůli obavám z dopadu nové politiky amerického prezidenta Donalda Trumpa, ale od začátku politického shromáždění 5. března je stále o více než 3 % výše. Technologický optimismus poslal minulý týden index na tříleté maximum, přičemž Čína během něj nabídla podporu umělé inteligenci.

Investoři z pevninské Číny se vrhli na čínské akcie obchodované v Hongkongu a učinili z nich jedny z nejvýkonnějších na světě. Citigroup Inc. mezitím zvýšila hodnocení trhu s tím, že po nedávné rally vypadá stále atraktivně.

„Zatímco všeobecná nálada na snížení rizika způsobená výprodejem amerických akcií se šíří do celého světa, jsem ohledně čínských akcií optimističtější,“ uvedl Francis Tan, hlavní stratég pro Asii ve společnosti Indosuez Wealth Management, a dodal, že investoři hledají alternativy k americkým akciím s ‚přesvědčivějším‘ oceněním.

„Celosvětové hledání vedlo k Číně, která je outsiderem,“ řekl Tan.

Ještě v roce 2018 procházely čínské akcie také obdobím optimismu, přičemž index MSCI China dosáhl v lednu desetiletého maxima. Brzy se však znovu objevila skepse a v říjnu téhož roku se ukazatel propadl na 17měsíční minimum.

Trade Breakdown and Trading Tips for the British Pound

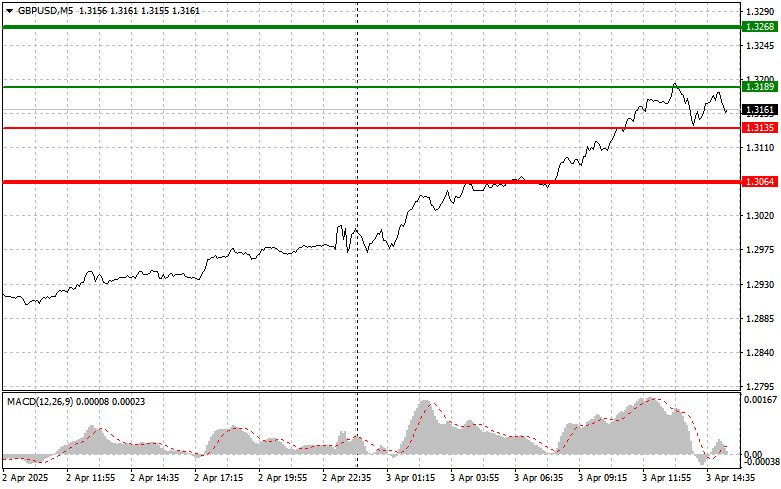

The test of the 1.3077 level coincided with the MACD indicator just beginning to rise from the zero line, confirming a correct entry point for buying the pound. As a result, the pair climbed to the target level of 1.3155.

Despite unimpressive UK Services PMI figures, speculation that Trump's new tariffs would negatively affect the U.S. dollar and economy more than the global economy triggered renewed buying of the pound.

Ahead lies the publication of the ISM Services PMI. Only very strong U.S. macroeconomic indicators might support the dollar—possibly the last of such support, considering Trump's tariff policy. Investors will also be watching public statements from FOMC members. A speech by FOMC member Philip N. Jefferson will provide insight into his assessment of the economy and future monetary policy outlook. His remarks may hint at the Fed's intentions regarding future tightening or easing. FOMC member Lisa D. Cook will also speak, and her views on inflation and employment will help assess the broader discussion trend within the FOMC.

As for the intraday strategy, I will mainly focus on implementing Scenario #1 and Scenario #2.

Buy Signal

Scenario #1: Today, I plan to buy the pound around the entry point at 1.3189 (green line on the chart) with a target of 1.3268 (thicker green line on the chart). Around 1.3268, I will exit long positions and open shorts in the opposite direction, aiming for a 30–35 point pullback. Pound strength today can be expected to continue the trend. Important: Before buying, make sure the MACD indicator is above the zero line and just beginning to rise.

Scenario #2: I also plan to buy the pound in case of two consecutive tests of the 1.3135 level, when the MACD indicator is in oversold territory. This will limit the downward potential and likely trigger a market reversal upward. A rise to the opposite levels of 1.3189 and 1.3268 can be expected.

Scenario #1: I plan to sell the pound after breaking below the 1.3135 level (red line on the chart), which would likely trigger a sharp decline. The main target for sellers will be the 1.3064 level, where I will exit shorts and open longs in the opposite direction, targeting a 20–25 point rebound. Sellers may gain momentum if U.S. employment data is strong. Important: Before selling, ensure the MACD indicator is below the zero line and just starting to decline.

Scenario #2: I also plan to sell the pound if the price tests the 1.3189 level twice in a row while MACD is in overbought territory. This will limit upward potential and may lead to a reversal down toward 1.3135 and 1.3064.

Chart Guide

Important Reminder for Beginners:

Beginner Forex traders should exercise caution when entering the market. It's best to stay out of the market before key fundamental reports to avoid sharp price fluctuations. If you decide to trade during news releases, always set Stop Loss orders to minimize losses. Without Stop Losses, you could quickly lose your entire deposit—especially if you don't use money management and trade large volumes.

And remember: successful trading requires a clear trading plan, like the one provided above. Making spontaneous trade decisions based on current market conditions is inherently a losing strategy for intraday traders.

TAUTAN CEPAT