Trade Breakdown and Euro Trading Advice

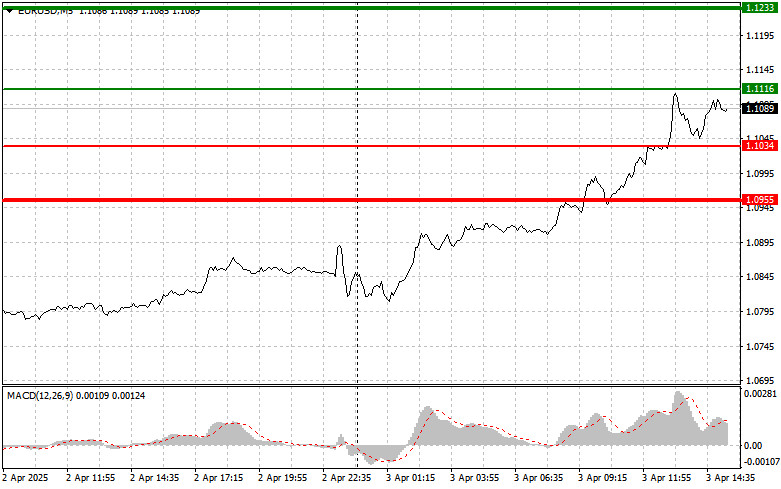

The test of the 1.0928 price level occurred just as the MACD indicator began moving up from the zero line, confirming the correct entry point for buying euros in a bullish market. As a result, the pair rose to the target level of 1.1019.

Strong data on services sector activity in the Eurozone triggered heavy euro buying. The services PMI index exceeded expectations, indicating the region's economic resilience despite global challenges. This boosted investor confidence in the euro's prospects and triggered a wave of buy orders. The improvement in economic indicators also reduced pressure on the European Central Bank to further ease monetary policy. Previously, concerns about slowing economic growth had led analysts to speculate that the ECB might implement additional stimulus measures.

During today's U.S. session, several reports will be released, including weekly initial jobless claims, the trade balance, and the ISM Services PMI. These data points are expected to influence the dollar's movement. Traders will closely analyze the figures for insights into the state of the U.S. economy and the outlook for Federal Reserve policy — especially in light of the tariffs introduced yesterday by Donald Trump. Weak data would be a reason to continue selling the dollar.

As for the intraday strategy, I will focus on executing Scenario #1 and Scenario #2.

Buy Signal

Scenario #1: Buy the euro today upon reaching the 1.1116 level (green line on the chart) with a target of 1.1233. At 1.1233, I plan to exit and sell the euro in the opposite direction, aiming for a 30–35 point move from the entry point. You can count on further euro growth today as part of the ongoing uptrend, especially if U.S. data is weak and Fed officials issue dovish comments. Important: Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: Also consider buying the euro after two consecutive tests of the 1.1034 price level when MACD is in the oversold zone. This will limit the downward potential and could trigger a reversal to the upside. You can expect a rise to the opposite levels of 1.1116 and 1.1233.

Scenario #1: Sell the euro after reaching the 1.1034 level (red line on the chart). The target will be 1.0995, where I will exit and immediately open a long position (expecting a 20–25 point bounce). It's unlikely that bearish pressure will return today. Important: Before selling, make sure the MACD indicator is below the zero line and just beginning to decline from it.

Scenario #2: Also consider selling the euro if the price tests 1.1116 twice in a row while the MACD is in the overbought zone. This will limit the pair's upward potential and may lead to a reversal down toward 1.1034 and 1.0995.

Chart Explanation

Important Reminder for Beginners:

Forex beginners should make entry decisions with caution. It's best to stay out of the market before the release of key fundamental reports to avoid sharp price swings. If you decide to trade during news releases, always set Stop Loss orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes.

And remember: successful trading requires a clear plan, like the one above. Making spontaneous decisions based on current market movements is an inherently losing strategy for intraday traders.

TAUTAN CEPAT