The dollar's reaction to Jerome Powell's hawkish comments has been surprisingly calm. The greenback was supposed to strengthen on clear signs of the monetary policy tightening, thus putting pressure on gold.

Apparently, the new virus strain Omicron has influenced the assets as their dynamics were mostly shaped by this kind of news. Since not much is known about this variant, any positive or negative reports about it can provoke a nervous swing in the markets.

Now the tension has slightly eased as more and more reports, including that from the World Health Organization, confirm that the existing vaccines will be effective against the new strain. In addition, GlaxoSmithKline announced the efficiency of an antibody-based coronavirus drug which is under development.

Healthcare officials in Australia have reported that newly detected cases are no more severe than the ones caused by the previous strains. Besides, the mortality rate has not increased. The risks associated with a worsening epidemiological situation and possible national lockdowns in major world economies are declining.

Traders may instead focus on tightening of the US monetary policy in the near future. In this case, the US dollar is likely to see a sharp rise, while gold may face a steep decline.

At the moment, the USD chart has no clear direction. As a rule, such pauses are usually followed by clearly distinguished movements either up or down.

Previously, the US dollar index posted the fastest rally this year and went up by 3% in two weeks. Such a spurt provoked a wave of profit-taking, and traders still prefer to be in a wait-and-see mode. What will happen next? The markets are quiet in anticipation.

Omicron and the tightening of the Fed's policy have come to the forefront. Despite the encouraging news about the virus, markets are still worried that a negative discovery regarding the new strain may appear at any moment. So, it is still too early to make a conclusion. If the Omicron factor outweighs the tightening of the monetary policy in the US, investors may flee from the US dollar and return to gold.

If so, USDX may fall below 95.90, which will generate downward momentum.

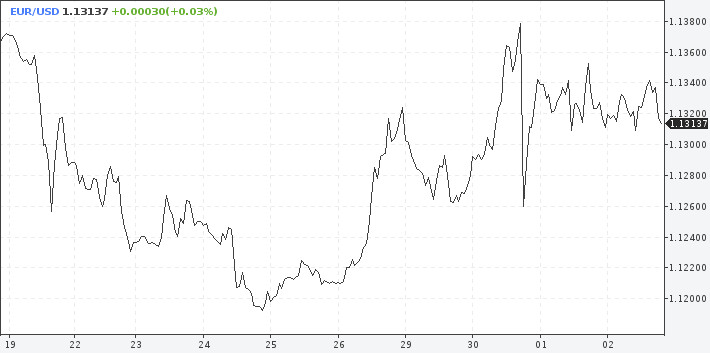

The NFP report will be released on Friday. Traders are looking ahead to this publication, which means that the US dollar will stand still until the report is published. Therefore, the EUR/USD pair will not be able to leave the resistance area formed at 1.1350-1.1360.

Meanwhile, the ADP data turned out to be above the forecast yesterday, which suggests that Nonfarm payrolls will also be strong. This is essential for the US dollar. The downbeat employment data will put the policy tightening under question.

The bearish scenario for the US currency looks quite realistic now, given that December is not a favorable month for the dollar. Amid increased inflationary pressure in the eurozone, EUR/USD has good prospects to rise, albeit in a short term. The euro is likely to develop a bullish pullback towards 1.1600.

TAUTAN CEPAT