Yesterday, gold set a new all-time high, approaching the $4,000 per ounce mark. This occurred amid rising market uncertainty driven by the U.S. government shutdown and the ongoing political crisis in France. In addition, global economic instability and slowing growth in China have added to investor nervousness, prompting a shift toward safer currencies and assets.

The price of gold rose to $3,977.44 per ounce after gaining 1.9% on Monday. The U.S. government shutdown, now in its second week, has deprived investors of key economic data needed to assess the state of the U.S. economy. This complicates the Federal Reserve's ability to evaluate shifting conditions. Traders continue to price in a 25-basis-point rate cut this month, which is supportive for gold as it doesn't yield interest.

The political crisis in France is further dampening investor sentiment. Instability in one of the eurozone's largest economies poses risks for the entire currency bloc, raising concerns that fresh economic problems may emerge. In such conditions, gold, as a traditional safe-haven asset, is experiencing significant demand.

As a reminder, French Prime Minister Sebastien Lecornu resigned after unsuccessful attempts to reach a consensus with political parties regarding budget expenditures. This stalemate has derailed efforts to curb what is currently the largest budget deficit within the eurozone.

The combination of the U.S. government shutdown and political instability in France has created a favorable environment for gold. Investors are looking to shield their assets from risk, and precious metals remain one of the most reliable methods for doing so. In the short term, further price appreciation in gold can be expected. However, long-term prospects remain uncertain, depending on several unpredictable factors.

U.S. President Donald Trump has been a major driver of gold's rally this year, with his aggressive actions in reshaping global trade and geopolitics triggering a flight to safety and a move away from the U.S. dollar. Central banks and gold-backed ETFs have been eagerly buying gold, and the Fed's rate cuts—and the likelihood of further cuts—have only supported this trend.

Goldman Sachs Group Inc. has raised its price forecast for December 2026 from $4,300 to $4,900 per ounce, citing inflows into ETFs and increased central bank purchases.

Silver remains stable above $48 per ounce, as does platinum, while palladium has continued to climb.

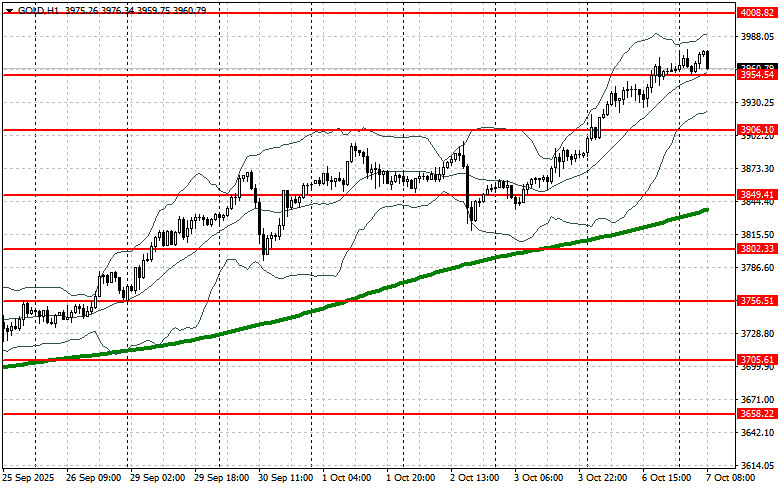

From a technical perspective, gold buyers need to break through the nearest resistance at $4,008. This would open the way to $4,062, although overcoming this level could prove quite difficult. The longer-term target sits around the $4,124 area.

If gold prices fall, bears will attempt to reclaim control at $3,954. A successful breach of this range would deal a serious blow to the bullish trend and push gold toward the $3,906 level, with the potential to reach as low as $3,849.

QUICK LINKS