Ethereum se v pondělí v 17:23 (22:23 SEČ) na indexu Investing.com obchodovalo za 3 550,21 USD, což představuje pokles o 11,05 %. Jednalo se o největší jednodenní procentuální ztrátu od 9. prosince.

Tento pohyb směrem dolů stlačil tržní kapitalizaci Etherea na 437,65 miliardy dolarů, což představuje 12,79 % celkové tržní kapitalizace kryptoměn. Na svém vrcholu činila tržní kapitalizace Etherea 569,58 miliardy dolarů.

V předchozích čtyřiadvaceti hodinách se Ethereum obchodovalo v rozmezí 3 550,21 USD až 4 005,08 USD.

Za posledních sedm dní zaznamenalo Ethereum stagnaci hodnoty, když se posunulo pouze o 0,61 %. Objem Etherea zobchodovaný za čtyřiadvacet hodin do doby psaní článku činil 51,37 miliardy dolarů, což představuje 17,48 % celkového objemu všech kryptoměn. Za posledních 7 dní se obchodoval v rozmezí od 3510,1943 USD do 4084,9895 USD.

Při své současné ceně se Ethereum stále nachází o 27,01 % níže než na svém historickém maximu 4864,06 USD, které bylo stanoveno 10. listopadu 2021.

He who laughs last, laughs best. At the end of 2022, hardly anyone refrained from mocking Bitcoin. The cryptocurrency lost two-thirds of its value, a crypto winter set in, and numerous scandals, bankruptcies, and frauds undermined trust in the industry. Ultimately, what is Bitcoin? It doesn't pay dividends, isn't backed by government guarantees, and lacks real value since it doesn't have tangible assets behind it. Why buy BTC/USD?

The version with a limited number of tokens, allowing the cryptocurrency to act as a hedge against the U.S. dollar, also seems dubious. Many mints produce a limited quantity of goods, but its value doesn't necessarily increase. Perhaps Bitcoin's main advantage lies in its volatility. It is higher than that of the S&P 500 and Forex instruments.

Volatility Dynamics of Bitcoin, S&P 500, and EUR/USD

Volatility is the lifeblood of traders. So, when BTC/USD had a reason to rise due to expectations of the Securities and Exchange Commission's approval of Bitcoin ETF applications, interest in the cryptocurrency sharply increased. As a result, by the end of 2023, people stopped laughing at it – the market capitalization almost doubled, and Bitcoin surpassed its competitors – stocks, bonds, and currencies, jumping 160% in a year.

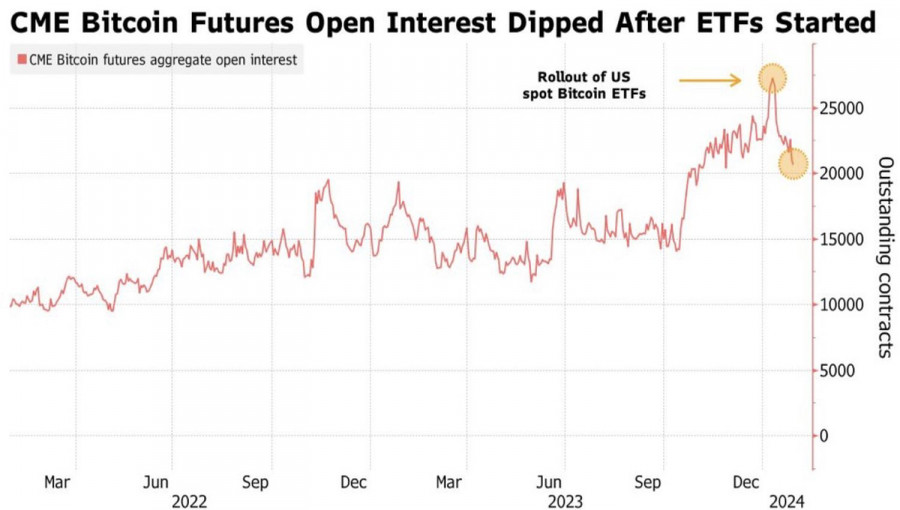

Simultaneously, open interest in cryptocurrency futures was rising. It reached its peak at the moment of the SEC's positive verdict. Subsequently, the principle of "buy on rumors, sell on facts" was implemented. BTC/USD quotes collapsed and, along with them, open interest.

Open Interest Dynamics in Bitcoin Futures

January became the fifth consecutive month when the token increased in value. If Bitcoin manages to close February in the green zone as well, it will repeat the record set from October 2020 to March 2021. A few months later, in November, BTC/USD quotes soared to an all-time high of 69,000 thanks to cheap liquidity from the Fed due to the pandemic. Currently, investors expect new monetary stimulus from the Fed in the form of a 125 bps federal funds rate cut in 2024. Will history repeat itself? Is a new record for the token just around the corner?

The answer to this question will likely depend on whether the Fed gives the market what it expects from the Central Bank. The prices of many assets are influenced by the factor of reducing borrowing costs from 5.5% to 4.25%. For the rally of risky assets, led by U.S. stock indices, to continue, expectations must align with reality. And for that, there needs to be a deterioration in statistics, starting with employment in the United States.

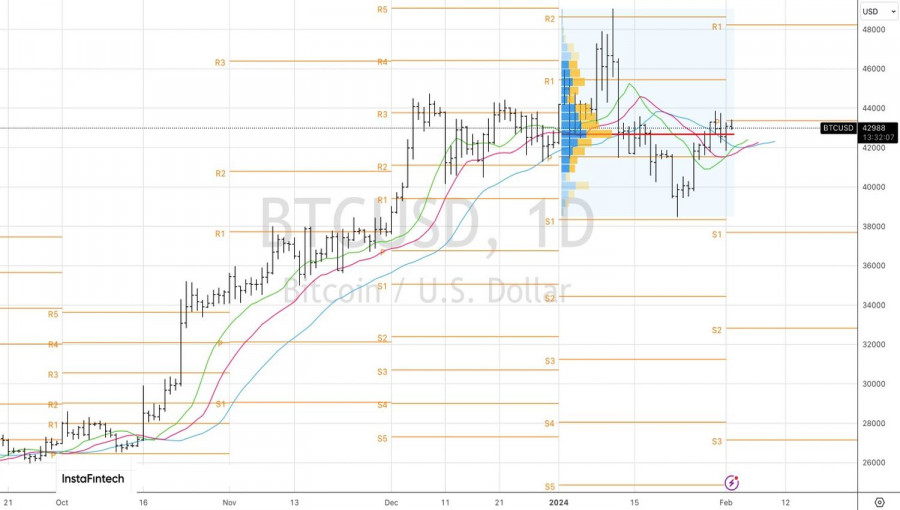

Technically, on the daily chart of BTC/USD, the breakthrough of moving averages from bottom to top and the successful assault on the fair value suggest the seriousness of the bulls' intentions to restore the upward trend. To continue the rally, a test of the pivot level at 43,715 is needed, which will be the basis for buying.

QUICK LINKS