Let's move on to the next tax—the dividend income tax. Starting April 6 next year, all rates will increase by 2%. Economists point out that for many small business owners, these 2% are significant. Previously, directors of small enterprises and firms could pay themselves a minimal salary while receiving the rest of their earnings as dividends, but now they will have to pay more taxes on that amount. An additional 2% tax on the company's overall income is quite substantial.

The next tax is on the luxury housing tax. From 2028, owners of luxury apartments and houses will pay an annual rate on their property. The tax will apply to properties valued at over £2 million. The minimum payment amount will be £2,500 per year, while the maximum will be £7,500. This is not the only tax on luxury property in the UK. There is already a municipal tax on such property that remains unchanged. What was one tax has now become two.

Capital gains tax will also see an increase. Starting from 2026, the tax rate on capital gains will be raised to 18%. In simpler terms, the sale price of a business will rise. Previously, an entrepreneur could pay tax at a reduced rate (10%) if they had owned the company and worked in it for a sufficient amount of time. From 2026, they will pay the full 18%.

Inheritance tax mirrors the income tax. While the tax rate itself has not increased, the thresholds for entering various tax brackets have been frozen. In simpler terms, prices are constantly rising, which means the actual tax payments will also increase as the property's value rises. Many exemptions related to this tax have been removed.

It should also be noted that there is a new tax on electric vehicles. In addition to the existing excise duty on all vehicles, an excise will be introduced for "efficient and beneficial" electric and hybrid vehicles. This will be set at 3 pence per mile and is intended to double the funding for road repairs in the UK.

The tax on rental income has been increased by 2%. The tax on savings income has also increased by 2%. The dividend tax credit for non-residents has been abolished. The income tax deduction for unreimbursed expenses for home workers and self-employed individuals has also been eliminated.

Based on all of the above, UK taxes have risen significantly, although many primarily affect wealthy Brits. However, it is important to remember that the majority of tax revenue comes from the lower and middle classes, who outnumber the wealthy in any country.

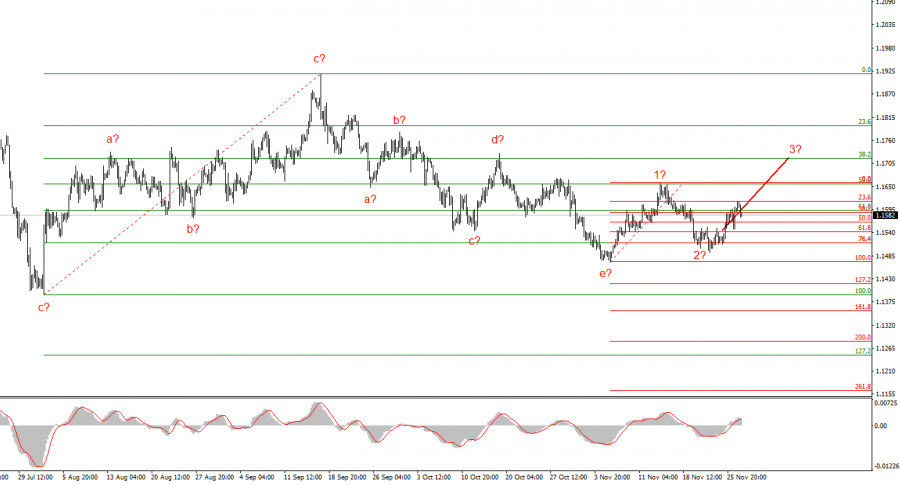

Based on the conducted analysis of EUR/USD, I conclude that the instrument continues to build an upward segment of the trend. In recent months, the market has paused, but Donald Trump's policies and the Federal Reserve remain significant factors in the future decline of the U.S. currency. The targets for the current segment of the trend may extend to the 25th figure. Currently, the formation of the upward wave set may continue. I expect that from the current positions, the third wave of this set will continue, which can be either "c" or "3." At this moment, I remain in long positions with targets around the 1.1740 mark.

The wave structure of the GBP/USD instrument has changed. We continue to deal with an upward, impulsive segment of the trend, but its internal wave structure has become complex. The downward corrective structure a-b-c-d-e in "4" appears quite complete. If this is indeed the case, I expect the main trend segment to resume its formation with initial targets around the 38 and 40 figures. In the short term, one can expect the formation of wave "3" or "c" with targets around 1.3280 and 1.3360, corresponding to 76.4% and 61.8% on the Fibonacci scale.

QUICK LINKS