Due to a sharp drop in market volatility during the first half of the day, I did not trade at all through the Mean Reversion scenario. On the other hand, using the Momentum strategy, one could have worked well with the Japanese yen, which fell sharply against the US dollar.

In the absence of economic data from the Eurozone and the UK, the euro and the British pound slightly declined against the US dollar, losing bullish momentum. Investors adopted a wait-and-see approach, assessing the prospects for further policy actions by the European Central Bank and the Bank of England, while also awaiting the release of the UK budget for the next year.

During the US session, key data are expected on weekly initial jobless claims, changes in durable goods orders, and the Chicago PMI. These macroeconomic indicators are key measures of the largest economy in the world and can significantly influence currency pair dynamics. The release of jobless claims data will provide traders with fresh insight into the US labor market. A decrease in claims may indicate a strengthening labor market and, consequently, support the US dollar.

Changes in durable goods orders are an important barometer of manufacturing activity. An increase in orders signals higher corporate investment and optimistic economic prospects, which is usually positive for the dollar. Finally, the Chicago PMI is a regional indicator of business activity in Chicago and is often viewed as a precursor to the national ISM index. A reading above 50 points indicates expanding business activity, while a reading below 50 points signals contraction.

If the data is strong, I will rely on the Momentum strategy. If the market does not react, I will continue to use the Mean Reversion strategy.

Momentum Strategy (Breakout) for the Second Half of the Day:

EUR/USD

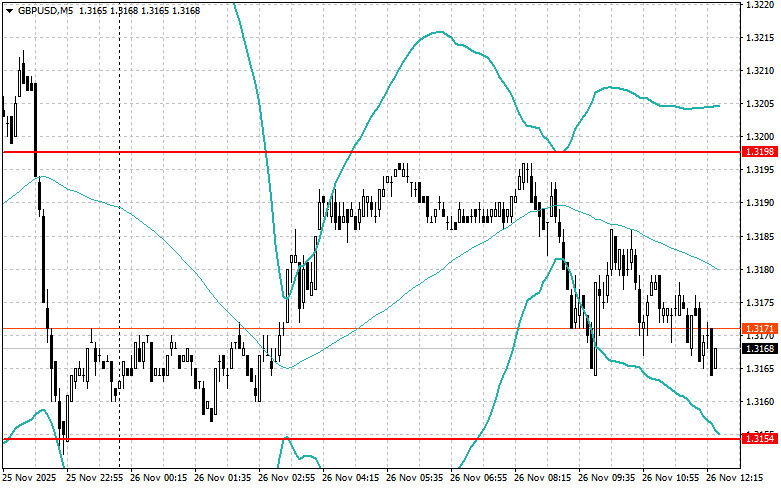

GBP/USD

USD/JPY

Mean Reversion Strategy (Pullback) for the Second Half of the Day:

EUR/USD

GBP/USD

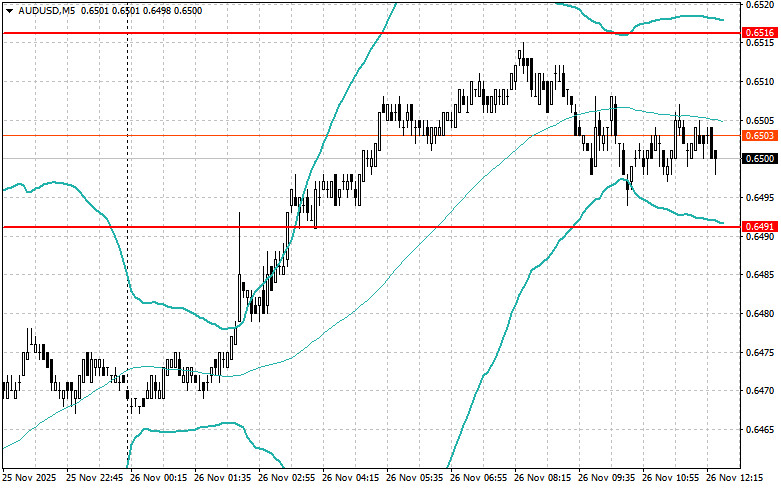

AUD/USD

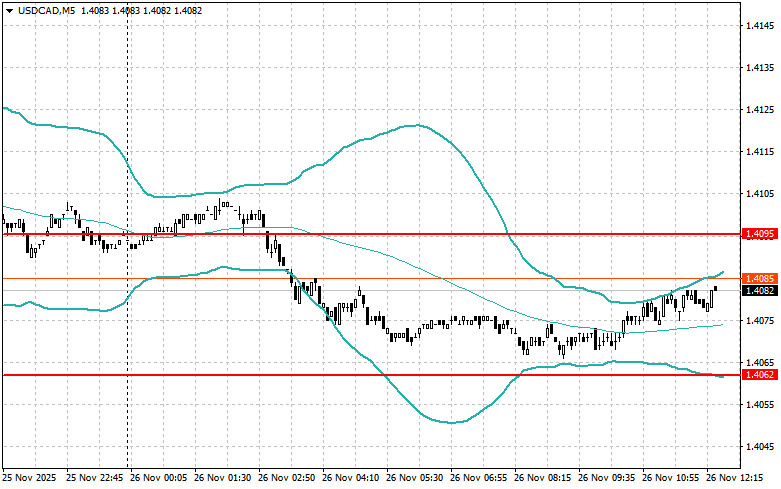

USD/CAD

QUICK LINKS