The GBP/USD currency pair remained stagnant on Wednesday. If the U.S. dollar had continued to rise yesterday, it would not have come as a surprise, as there were solid reasons for the dollar to rise—namely, the ISM services activity index and the ADP report both showed higher values than anticipated. However, there is still very little logic in the current market movements. More precisely, the dependency of movements on macroeconomic and fundamental factors is minimal. The GBP/USD pair continues to trade based solely on technical factors. The situation we observe is as follows: on Monday and Tuesday, the dollar had no reason to rise, yet it did. On Wednesday, there were reasons for growth, but it fell instead. Today, the Bank of England will hold a meeting, and the results may be surprising, potentially resulting in almost any reaction from the market. Thus, volatility could be high today.

On the hourly timeframe, the GBP/USD pair is continuing to form a new downward trend. Currently, the British pound is declining for virtually any reason. As we have already mentioned, there are no grounds for sustained dollar growth; therefore, in the medium term, we only anticipate upward movement. However, the flat factor in the long term continues to pull the pair down, which represents an entirely illogical development.

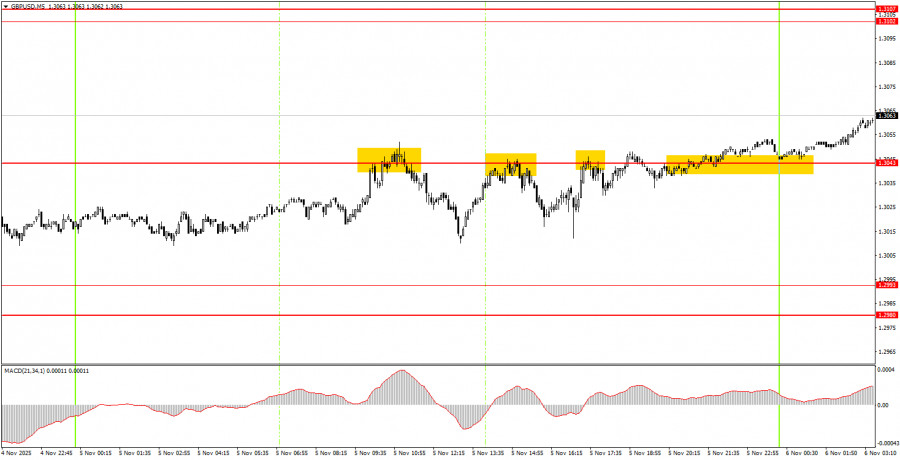

On Thursday, novice traders may hold long positions from last night's buying signal or wait for a new buy signal around 1.3043. The target is 1.3102. If the pair consolidates below 1.3043, short positions can be considered, targeting 1.2993.

On the 5-minute timeframe, levels to consider are 1.2913, 1.2980–1.2993, 1.3043, 1.3102–1.3107, 1.3203–1.3211, 1.3259, 1.3329–1.3331, 1.3413–1.3421, 1.3466–1.3475, 1.3529–1.3543, and 1.3574–1.3590. On Thursday, the UK is scheduled to release reports on retail sales and industrial production. However, at this time, the market is not paying much attention to macroeconomic data.

Important announcements and reports (always available in the news calendar) can significantly impact the movement of the currency pair. Therefore, during their release, it is recommended to trade with maximum caution or to exit the market to avoid sharp reversals against the preceding movement.

Beginners trading on the Forex market should remember that not every trade can be profitable. Developing a clear strategy and money management is key to long-term success in trading.

QUICK LINKS