Gold prices have fallen again as three Federal Reserve policymakers have voiced support for a more cautious approach toward lowering interest rates next month.

The price of gold dropped below $3,985 per ounce, and Federal Reserve Chair Lisa Cook stated that she believes the risk of further weakening in the labor market outweighs the risk of accelerating inflation, but she refrained from hinting at further rate cuts in December this year. These comments resonate with statements from her two colleagues, Mary Daly and Austan Goolsbee.

As a result, investors who were previously optimistic about imminent monetary policy easing are reassessing their positions. The strengthening dollar that followed the Fed officials' statements has also put additional pressure on gold prices, which are traditionally traded in US dollars.

However, it should be noted that the decline in gold prices may be temporary. Inflationary risks, despite some stabilization, remain relevant. Geopolitical uncertainty and global economic instability could also support demand for gold as a safe haven. Thus, the further direction of gold prices will depend on a multitude of factors, including the much-lacking macroeconomic data, political events, and Fed decisions. Investors are advised to remain vigilant and consider all risks when making investment decisions.

As a reminder, the precious metal peaked at a record level in the middle of last month, only to sharply decline amid fears that the price increase was too rapid. Traders are trying to determine whether the growth will resume, with forecasts partially shaped by the Fed, as US monetary policy easing makes non-yielding gold more attractive.

At the end of last month, Fed Chair Jerome Powell also cautioned investors against assuming that the US central bank would implement another rate cut in December, as his statements were aimed at tempering market expectations. Currently, traders estimate the probability of a Fed rate cut next month at approximately 67%, down from two weeks ago, when this decision was fully priced in.

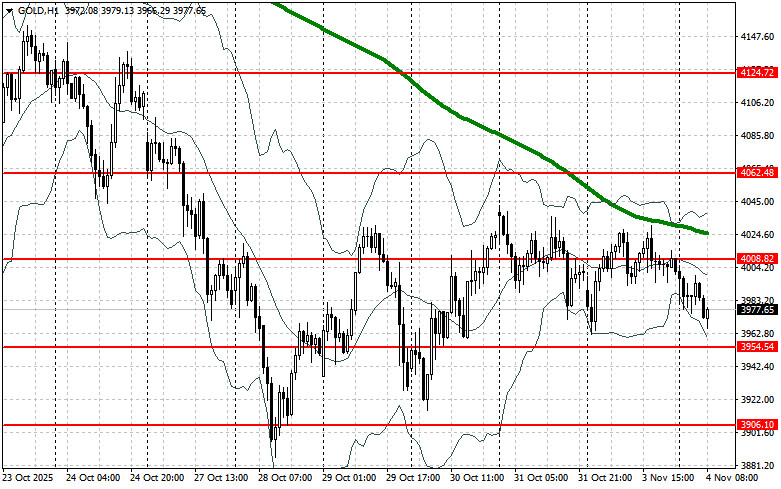

Regarding the current technical picture for gold, buyers need to overcome the nearest resistance at $4,008. This will allow them to target $4,062, beyond which it will be quite challenging to break through. The farthest target will be the area of $4,124. In the event of a gold price drop, bears will attempt to take control at $3,954. If they succeed, breaking through this range will deliver a significant blow to the bulls' positions and push gold down to a minimum of $3,906, with the potential to drop to $3,849.

QUICK LINKS