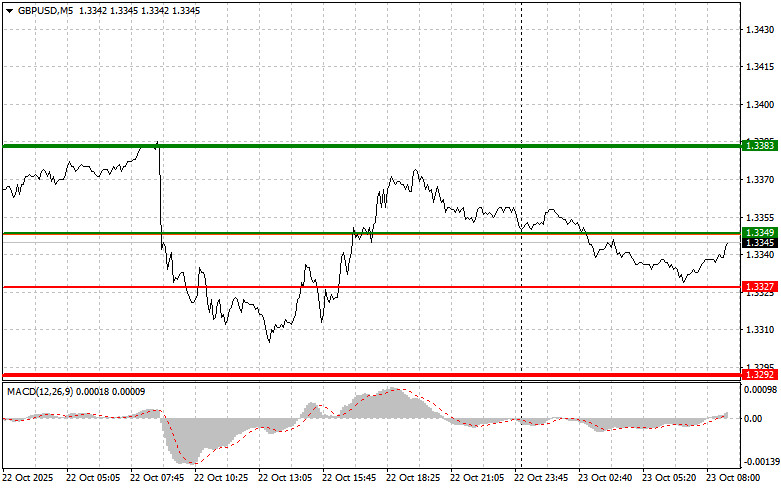

The test of the 1.3326 level occurred when the MACD indicator had just started to rise from the zero line. This confirmed a valid entry point for buying the pound, resulting in a 30-pip upward move.

The pound dropped sharply in the first half of the previous day following news that UK core inflation had declined. This unexpected development triggered a wave of selling in the British currency, as investors reassessed their expectations regarding future Bank of England actions. Reduced inflationary pressure could give the central bank more room to maneuver and reduce the need for aggressively high interest rates.

However, it is too soon to jump to conclusions. The broader UK economic situation remains complex and is influenced by multiple factors, including political risks and inflation.

Today, the Confederation of British Industry is expected to release data reflecting the state of industrial order books. Additionally, BoE Monetary Policy Committee member Swati Dhingra is scheduled to speak. If her comments take on a dovish tone in response to the recent inflation data, they may apply further pressure on the pound.

For intraday trading, I will primarily rely on the execution of Scenarios #1 and #2.

Scenario 1: I plan to buy the pound today at the entry zone around 1.3349 (thin green line), targeting a rise toward 1.3383 (thick green line). Once the pair reaches the 1.3383 area, I will close long positions and consider opening shorts in anticipation of a reversal, targeting a 30–35 pip counter-move. A long trade today should only be considered in the case of strong, supportive economic data. Important: Before buying, confirm that the MACD indicator is above the zero line and just beginning to rise.

Scenario 2: I also plan to buy the pound if there are two consecutive tests of the 1.3327 level when the MACD is in the oversold zone. This scenario would limit downside potential and likely trigger an upward reversal. Targets in this case are 1.3349 and 1.3383.

Scenario 1: I plan to sell the pound if the pair breaks below 1.3327 (thin red line), which could lead to a quick decline. The first target for sellers will be 1.3292, where I will close the short position and consider buying on a reversal, aiming for a 20–25 pip bounce in the opposite direction. Bearish pressure would likely return on weaker-than-expected data. Important: Before shorting, confirm that the MACD is below the zero line and beginning to decline.

Scenario 2: I will also consider selling the pound after two consecutive tests of the 1.3349 level when the MACD is in the overbought zone. This would suggest limited upside momentum and a potential reversal downward. Expected targets in this case are 1.3327 and 1.3292.

Thin green line – price level used for potential buying opportunities

Thick green line – expected Take Profit area or manual exit level where further growth is unlikely

Thin red line – price level used for potential selling

Thick red line – expected Take Profit area or manual exit level where further decline is unlikely

MACD indicator – monitor for overbought/oversold conditions as confirmation for entry signals

Forex beginners must exercise caution when entering the market. Ahead of major fundamental releases, it's best to stay flat to avoid sudden price swings. If trading during high-impact events, always place stop-loss orders to minimize risk. Without stop-loss protection, especially when trading large positions without proper money management, your entire account can quickly be wiped out.

Remember: success in trading requires a clear plan—like the example provided above. Spontaneous decisions based on short-term price action alone are typically a losing strategy for intraday traders.

QUICK LINKS