Today, Wednesday, the EUR/USD pair halted its three-day losing streak, rising above the key psychological level of 1.1600.

On Tuesday, U.S. President Donald Trump rejected meeting requests from Democratic lawmakers, emphasizing that he would not negotiate until the full functionality of the government was restored. The government shutdown has now entered its fourth week, and on Monday the Senate failed for the eleventh time to reach a funding agreement.

In the absence of major economic releases from either the eurozone or the United States, traders focused mainly on the speeches of senior ECB officials, including President Christine Lagarde and Vice President Luis de Guindos. However, their remarks did not provide any meaningful clarity regarding the near-term outlook for the ECB's monetary policy.

Ahead lies a speech by a Federal Reserve representative, which is also expected to have little market impact. Therefore, to find better trading opportunities, it would be wise to wait for economic reports scheduled for Thursday.

From a technical perspective, despite the pair pausing its three-day decline, oscillators on the daily chart remain in negative territory, suggesting that the path of least resistance remains downward.

However, if prices manage to break above the nearest resistance levels at 1.1625 and 1.1650, the pair could advance toward the round level of 1.1700. A decisive move above that level would give bulls a real chance to regain control.

For now, the daily chart trajectory remains bearish, and no bullish momentum has yet broken this trend — meaning the path of least resistance for the pair remains negative.

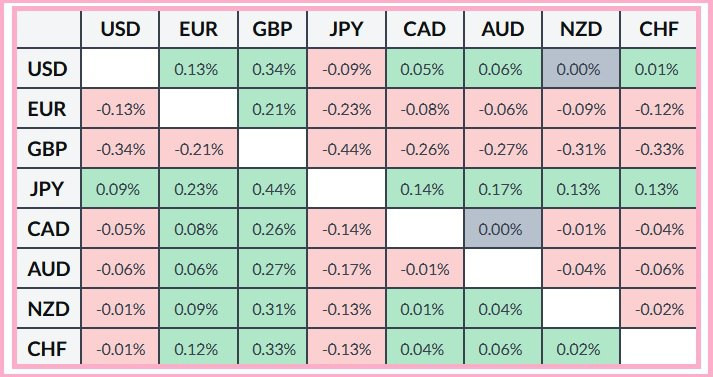

The table below shows the percentage changes of the euro against major world currencies. The euro demonstrated the greatest resilience relative to the British pound.

QUICK LINKS