But aren't they guilty themselves? It turns out Scott Bessent also listed two of his houses as his primary residence. Donald Trump called such actions by Lisa Cook mortgage fraud and a reason to dismiss her from her position as FOMC governor. Should the Treasury Secretary be fired as well? The U.S. president often presents wishful thinking as fact. This also applies to his calls for the Fed to cut the federal funds rate by 50 basis points or more. According to him, the central bank should listen to someone as smart as he is.

A massive sell-off of the U.S. dollar allowed EUR/USD to soar to 4-year highs. The euro has never risen so fast during the first nine months of a year as it has in 2025. The Fed remains fixated on the labor market. It's no surprise that investors are ignoring strong data on other important indicators – inflation and retail sales. Speculators continue to dump the U.S. dollar on expectations of a renewed cycle of monetary expansion.

Euro bulls are not deterred by either the escalation of the armed conflict in Ukraine, with Russian drones appearing on Polish territory, or the political crisis in France. These events are viewed as secondary. The main stage is set in Washington. Meanwhile, the eurozone's resilience to tariffs, against the backdrop of a cooling U.S. economy, provides additional tailwinds for EUR/USD bulls.

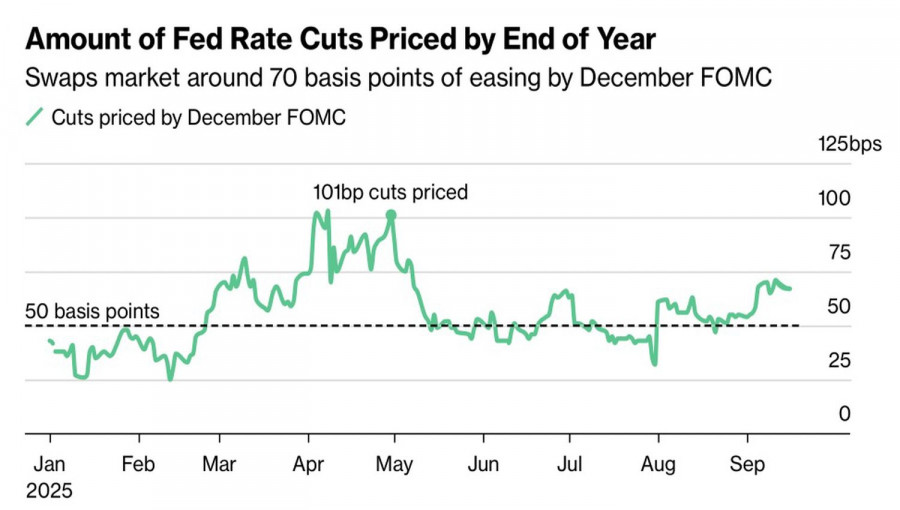

In the short term, the main currency pair may even extend its rally if updated federal funds rate projections show two cuts in 2025. The derivatives market is pricing in three, while Bloomberg experts expect two. The Fed will decide. The central bank's verdict will determine the short-term direction of EUR/USD. Over the longer horizon, however, the pair's fate seems predetermined.

In reality, the current situation painfully resembles the 1970s. President Richard Nixon shared the same desire to boost the U.S. economy through rate cuts. The same pressure on Fed Chair Arthur Burns. Eventually, he gave in. Monetary policy was loosened, and inflation returned. Prices began to surge uncontrollably, and the new central bank head, Paul Volcker, was forced into aggressive monetary tightening. The result is well known: a double-dip recession.

If Trump calls himself a smart man, he should know history and understand the pressure on the Fed that leads to it. In today's context, it is seen as a threat to central bank independence. And there's no worse scenario for the U.S. dollar.

Technically, on the daily EUR/USD chart, the uptrend has resumed, followed by a slight pullback of the bulls. They still hold the initiative. Therefore, a rebound from support at 1.182 or a return above the current bar's high at 1.187 should be used for buying.

QUICK LINKS