The EUR/USD currency pair pulled back slightly on Thursday, but the decline was mild and short-lived. In principle, the dollar still has no reason to grow, and the currency market is not like the crypto market — price movements here are much less volatile, and corrections do occur from time to time. Thus, today we might very well see another minor pullback, especially since there are no macroeconomic or fundamental drivers on the agenda. However, from a medium-term perspective, we still expect the EUR/USD pair to rise.

Among Thursday's macroeconomic events, only Germany's industrial production report is worth noting — and it was expectedly disappointing. However, it's worth recalling that this week, Trump introduced another round of tariffs, and traders have begun to worry about the loss of the Federal Reserve's independence and the reliability of future macroeconomic reports after the dismissal of the head of the U.S. Bureau of Statistics.

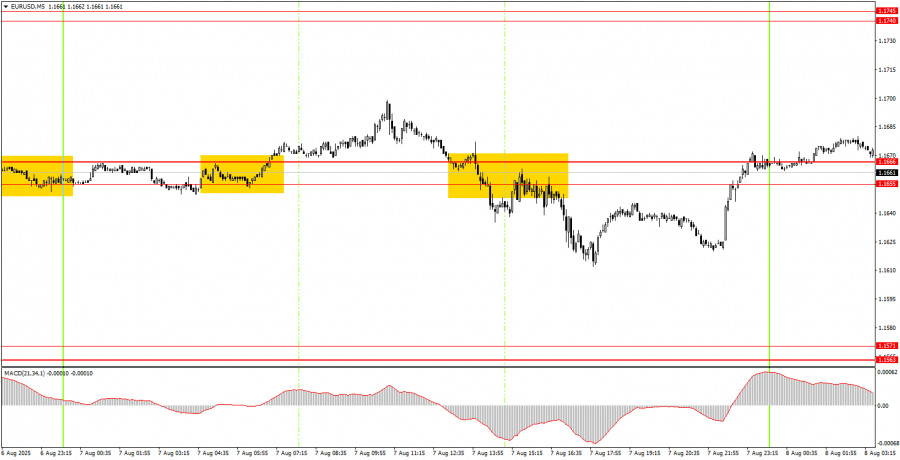

In the 5-minute time frame, the pair generated two trading signals on Thursday. During the European session, the price consolidated above the 1.1655–1.1666 area, and during the U.S. session, below it. In both cases, the price moved at least 20 pips in the expected direction. In the first trade, a breakeven Stop Loss likely triggered. In the second case, novice traders could have made a small profit by closing the position manually in the evening.

On the hourly timeframe, the EUR/USD pair has every chance to resume the uptrend that has been forming since the beginning of the year. The "house of cards" supporting the U.S. dollar collapsed last Friday. We had previously warned that there were no long-term grounds for the dollar's growth and had questioned the "optimism" surrounding Trump's policy and its early results. Friday confirmed we were right.

On Friday, EUR/USD may move in either direction due to the lack of news. That is, unless Trump makes another high-impact decision that shakes the market. Today, novice traders may consider trading off the 1.1655–1.1666 area, though the movement might resemble Thursday's behavior.

On the 5-minute timeframe, consider the following levels: 1.1198–1.1218, 1.1267–1.1292, 1.1354–1.1363, 1.1413, 1.1455–1.1474, 1.1527, 1.1552–1.1563–1.1571, 1.1655–1.1666, 1.1740–1.1745, 1.1808, 1.1851, 1.1908.

No important reports or events are scheduled today in the Eurozone or the United States. Thus, for now, all hope rests on Trump.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

QUICK LINKS