Analysis of Trades and Recommendations for Trading the British Pound

The test of the 1.3267 level occurred when the MACD indicator had just started to move downward from the zero line, confirming a valid entry point for selling the pound. However, the pair did not experience a significant decline.

The pound was supported in the first half of the day by relatively solid UK Services PMI data. Although the indicator showed a decline compared to the previous month, it still came in above expectations, providing some hope for traders. The services sector, being one of the key drivers of the British economy, demonstrated relative resilience amid broader macroeconomic uncertainty. That said, it's important not to overestimate the impact of a single indicator—the overall outlook for the UK economy remains complex.

Next, markets await the release of the U.S. ISM Services PMI, the composite PMI, and trade balance data. The ISM Services PMI serves as a key measure of the health of the U.S. economy. The composite PMI, which reflects both manufacturing and non-manufacturing sectors, will offer a more complete picture of overall economic activity. An upward trend in this indicator would confirm the economy's underlying strength—especially after last week's disappointing U.S. labor market report. The trade balance is also significant. A narrowing deficit or a move to a surplus would point to increased exports, which directly supports domestic production growth.

As for the intraday strategy, I will mainly rely on implementing Scenario #1 and Scenario #2.

Buy Signal

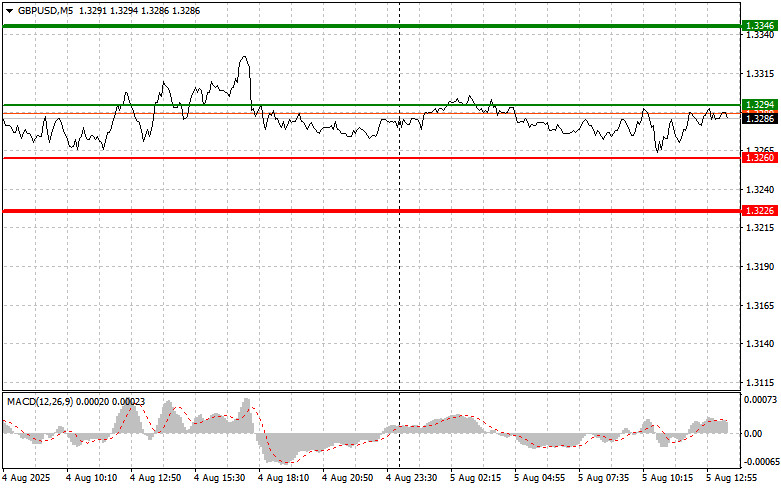

Scenario #1: I plan to buy the pound today at around 1.3294 (green line on the chart), targeting a rise toward 1.3346 (thicker green line on the chart). Around 1.3346, I will close long positions and open shorts in the opposite direction, aiming for a 30–35 point move. A strong pound today is only likely if U.S. data is weak. Important! Before buying, make sure the MACD indicator is above the zero mark and just starting to rise.

Scenario #2: I also plan to buy the pound if there are two consecutive tests of the 1.3260 level while the MACD indicator is in oversold territory. This would limit the downward potential and lead to a reversal. A rise toward 1.3294 and 1.3346 could follow.

Sell Signal

Scenario #1: I plan to sell the pound today after the 1.3260 level (red line on the chart) is updated, which should lead to a quick decline in the pair. Sellers will likely target the 1.3226 level, where I will close short positions and open long ones in the opposite direction, aiming for a 20–25 point rebound. Strong selling pressure is unlikely today. Important! Before selling, make sure the MACD indicator is below the zero line and just starting to fall.

Scenario #2: I also plan to sell the pound if there are two consecutive tests of the 1.3294 level while the MACD indicator is in overbought territory. This would limit the upward potential and prompt a reversal. A decline toward 1.3260 and 1.3226 could follow.

Chart Key:

Important: Beginner traders in the Forex market must be extremely cautious when entering trades. It's best to stay out of the market before major fundamental reports to avoid being caught in sharp price fluctuations. If you do choose to trade during news releases, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit—especially if you ignore money management principles and trade with large volumes.

And remember, successful trading requires a clear trading plan like the one outlined above. Making spontaneous trading decisions based on current market moves is a losing strategy for intraday traders.

QUICK LINKS