Agentura Moody’s Ratings potvrdila 8. dubna 2025 rating finanční síly pojišťovny Berkshire Hathaway Assurance Corporation (BHAC) na úrovni Aa1. BHAC je pojišťovna poskytující finanční záruky, kterou vlastní dceřiné společnosti společnosti Berkshire Hathaway Inc (NYSE:BRKa) Columbia Insurance Company a National Indemnity Company, jež jsou významnými členy pojišťovacího segmentu společnosti Berkshire. Výhled ratingu společnosti BHAC zůstává stabilní.

Rating Aa1 IFS společnosti BHAC odráží výslovnou podporu ze strany společnosti Columbia, která je poskytována prostřednictvím korporátní záruky ve prospěch společnosti BHAC. Tato záruka zajišťuje včasnou úhradu všech budoucích závazků a povinností společnosti BHAC z pojistných smluv o finančních zárukách. Rating je rovněž ovlivněn implicitní podporou ze strany společnosti Columbia i společnosti National Indemnity Company.

Samostatný úvěrový profil společnosti BHAC je charakterizován její silnou kapitálovou pozicí a vysoce kvalitním pojištěným portfoliem amerických veřejných finančních úvěrů, z nichž většina je pojištěna jinými finančními ručiteli. Tyto silné stránky jsou však vyváženy neaktivním statusem společnosti a omezenou infrastrukturou pro upisování, řízení rizik a dohled.

Trade Review and Tips for Trading the Japanese Yen

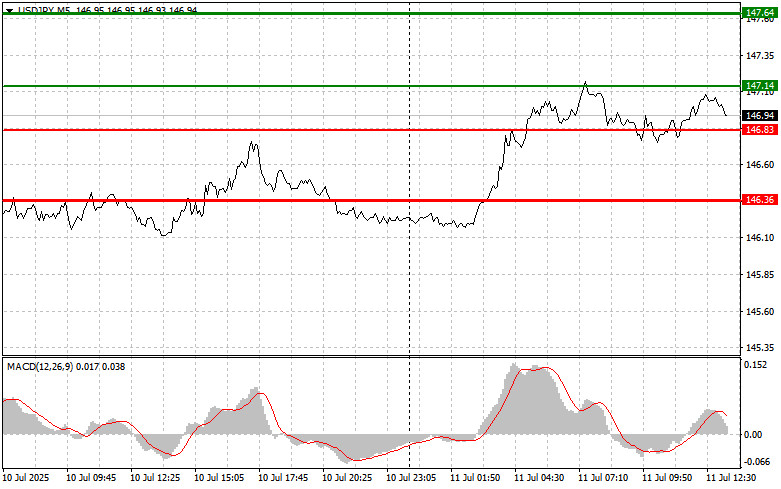

The price test at 146.83 occurred when the MACD indicator had already moved far below the zero line, limiting the pair's downward potential. Shortly afterward, the same level was tested again—this time with the MACD in the oversold zone—allowing Scenario #2 for buying the dollar to play out. As a result, the pair rose by more than 30 points.

The market seems to be waiting for more substantial drivers that could push USD/JPY out of its current range. Investors have adopted a wait-and-see approach, hesitant to act ahead of important events. Current volatility remains low, reflecting uncertainty among market participants. On the one hand, the dollar is supported by the generally positive performance of the U.S. economy; on the other, risks related to trade tensions and political instability continue to weigh on sentiment. Today, USD/JPY is unlikely to see any significant movement, so it may be best to delay trading decisions until next week.

However, investors will continue to monitor developments in trade negotiations. Any signs of progress could boost market optimism and support risk assets, which would likely cause the USD/JPY pair to decline.

For the intraday strategy, I will primarily rely on Scenarios #1 and #2.

Buy Signal

Scenario #1: I plan to buy USD/JPY today after the price reaches the 147.14 level (green line on the chart), with a target at 147.64 (thicker green line). Around 147.64, I plan to exit long positions and open short ones, anticipating a 30–35 point move in the opposite direction. A continued upward trend in the pair is likely. Important: Before buying, make sure the MACD indicator is above the zero line and just beginning to rise.

Scenario #2: I also plan to buy USD/JPY today if there are two consecutive tests of the 146.83 level while the MACD is in the oversold zone. This will limit the pair's downside and trigger a reversal to the upside. The targets in this case would be 147.14 and 147.64.

Sell Signal

Scenario #1: I plan to sell USD/JPY after the price breaks below 146.83 (red line on the chart), which could trigger a quick decline. The main target will be 146.36, where I will exit short positions and consider opening long ones, expecting a 20–25 point reversal. Selling pressure on the pair may return if weak economic data is released.Important: Before selling, ensure the MACD is below the zero line and just beginning to decline.

Scenario #2: I also plan to sell USD/JPY today if there are two consecutive tests of the 147.14 level while the MACD is in the overbought zone. This would limit the pair's upward potential and trigger a reversal to the downside. The expected targets would be 146.83 and 146.36.

Chart Notes:

Important: Beginner Forex traders should exercise caution when entering the market. It is best to stay out of trades before the release of major fundamental reports to avoid sharp price swings. If you do choose to trade during news events, always place stop-loss orders to minimize potential losses. Trading without stop-losses can result in the rapid loss of your entire deposit—especially if you neglect proper money management or use large position sizes.

And remember, successful trading requires a well-defined plan, like the one presented above. Making impulsive decisions based on current market conditions is usually a losing strategy for intraday traders.

QUICK LINKS