Scheduled Maintenance

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

During the European session on Monday, the GBP/JPY currency pair is approaching the 198.30 level. The pair finds some support from UK housing data: in June, house prices rose by 2.5% year-over-year, slightly below May's 2.6%, while monthly prices halted their decline, which was revised to -0.3%.

Nevertheless, the pound faces headwinds due to increasing concerns over the UK's fiscal policy. Chancellor Rachel Reeves signaled the possibility of tax increases in the autumn budget to reduce the deficit. In addition, the Labor Party abandoned a number of welfare reforms to avoid internal party conflicts, which are also linked to additional expenditures. Analysts at Deutsche Bank forecast a 25 basis point interest rate cut by the Bank of England in August, followed by two further cuts in November and December.

On the other side of the pair, the Japanese yen is under pressure from weak wage data: workers' income in May rose by only 1% year-over-year, significantly below expectations of 2.4%. This undermines hopes for monetary tightening by the Bank of Japan. Additional pressure on the yen came from comments by Prime Minister Shigeru Ishiba, who stated his reluctance to make compromises in trade negotiations with the U.S. in order to avoid high tariffs on Japanese exports.

Overall, GBP/JPY is trading within a narrow range, reflecting the balance between fiscal concerns in the UK and muted expectations regarding monetary policy in Japan.

From a technical standpoint, oscillators on the daily chart remain in positive territory, suggesting that the path of least resistance for the pair is upward. However, only a firm hold above the psychological level of 198.00 would allow the pair to move higher.

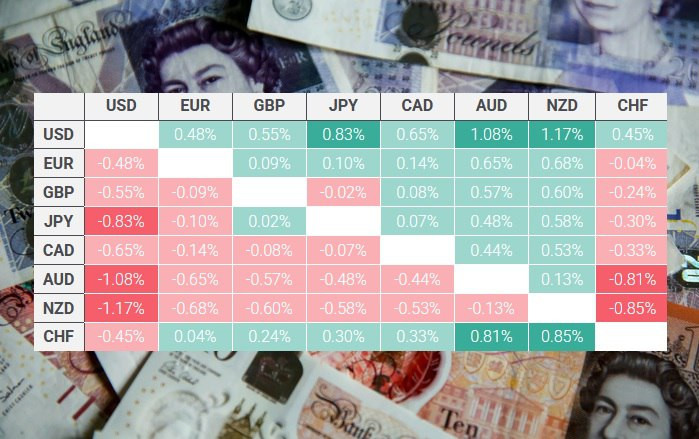

The table shows the percentage change in the British pound against the major listed currencies today.

Among the major currencies, the British pound showed the greatest strength today against the New Zealand dollar.

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

QUICK LINKS