Trade Analysis and Tips for Trading the Japanese Yen

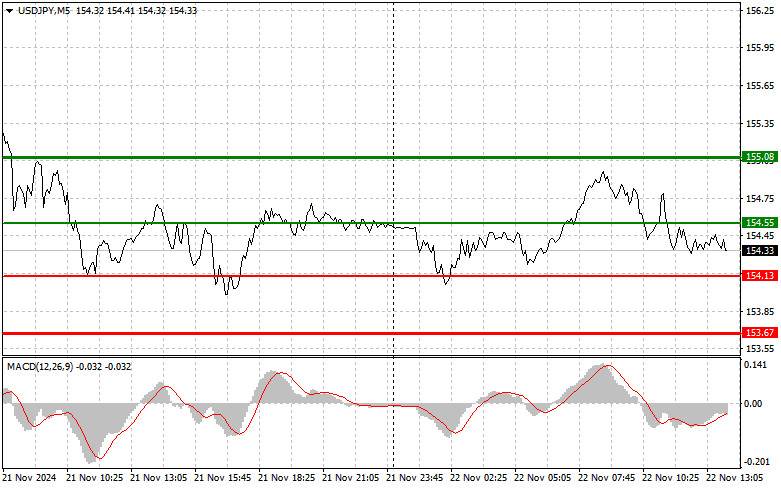

The price test at 154.73 in the first half of the day occurred as the MACD indicator began moving downward from the zero line, confirming a valid entry point to sell the dollar. As a result, the pair fell by about 50 points.

In the afternoon, US economic activity will drive further market movements. Weak manufacturing and services PMI data could provide reasons to sell USD/JPY. On the other hand, strong data, including a positive Consumer Sentiment Index from the University of Michigan, may boost dollar demand, potentially prompting another rise in USD/JPY later in the week. For intraday trading, I will focus on implementing Scenarios 1 and 2.

Scenario 1: I plan to buy USD/JPY today if the price reaches approximately 154.55 (green line on the chart), targeting a rise to 155.08 (thicker green line on the chart). Around 155.08, I will exit buy positions and initiate sell positions, expecting a 30–35 point movement downward. A rise in the pair is likely only if US data is strong.Note: Before buying, ensure the MACD indicator is above the zero line and starting to rise.

Scenario 2: I also plan to buy USD/JPY today if the price tests 154.13 twice, with the MACD indicator in the oversold zone. This setup would limit the pair's downward potential and could lead to a market reversal upward. In this case, I anticipate a rise toward 154.55 and 155.08.

Scenario 1: I plan to sell USD/JPY today if the price reaches 154.13 (red line on the chart), which could trigger a sharp decline. The key target for sellers is 153.67, where I will exit sell positions and open buy positions, expecting a 20–25 point rebound. Strong US data could reapply selling pressure to the pair.Note: Before selling, ensure the MACD indicator is below the zero line and starting to fall.

Scenario 2: I also plan to sell USD/JPY today if the price tests 154.55 twice, with the MACD indicator in the overbought zone. This setup would limit the pair's upward potential and likely lead to a market reversal downward. In this case, I anticipate a decline toward 154.13 and 153.67.

Beginner Forex traders must exercise caution when entering the market. Avoid trading before major economic reports to minimize risks from sharp price fluctuations. If you choose to trade during news releases, always set stop-loss orders to reduce risks. Without stop-loss orders, you could quickly lose your entire deposit, especially when trading large volumes without proper money management.

Successful trading requires a clear plan, such as the one outlined above. Reacting to immediate market fluctuations without a structured approach often leads to losses for intraday traders.

QUICK LINKS